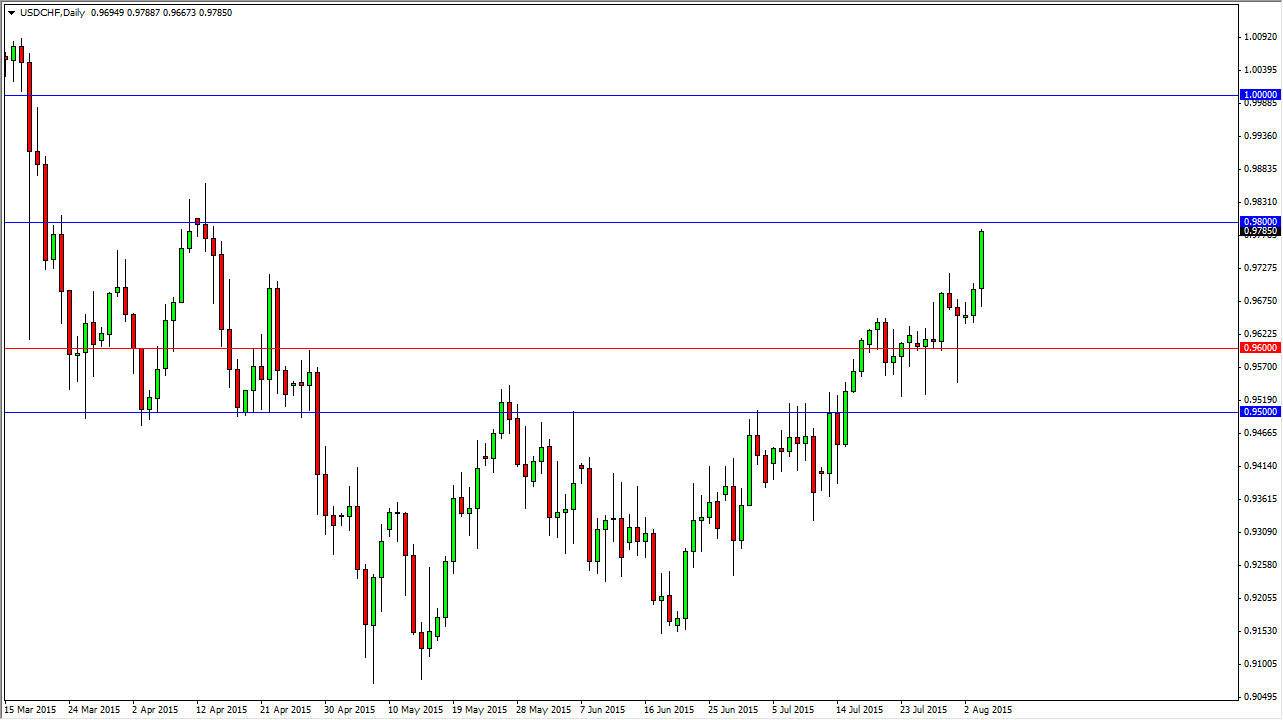

The USD/CHF pair initially fell during the course of the session on Tuesday, but found enough buyers underneath in order to turn the market back around and surge higher. By doing so, we tested the 0.98 level, which was my first target. With this, I believe that a pullback could come but ultimately we are going to test the parity level, as the Swiss National Bank continues to work against the value of the Swiss franc in general, although not necessarily in this pair. It does have a “knock on effect” though, so I believe that the Swiss franc in general is going to continue to soften. This will probably be especially true against the US dollar, which of course is doing much better than the Euro recently. It isn’t necessarily that there’s anything wrong with Switzerland per se, just that they are overly reliant on the European Union.

Buying pullbacks

I’m looking to short-term charts in order to buy pullbacks given enough time, as the market should continue to go higher. I think that the area between 0.96 and 0.95 should continue to be supportive, and that it’s only a matter of time before the buyers reenter the market every time we. I think that the market will not break down below the 0.95 level again, and that is essentially the “floor” in this pair at the moment.

It is the summertime though, so do not expect miracles. Simply put, I expect a lot of short-term trading going forward that should eventually push this market higher. I have no interest in selling again, at least not until we get below the aforementioned 0.95 handle which is something that I just do not see happening this time year. In fact, when you look at the larger chart, you can make out a bit of a “W pattern”, which of course is very bullish as well. Longer-term I think this pair goes much higher, and that we could be getting ready to see a bit of a multi-year move.