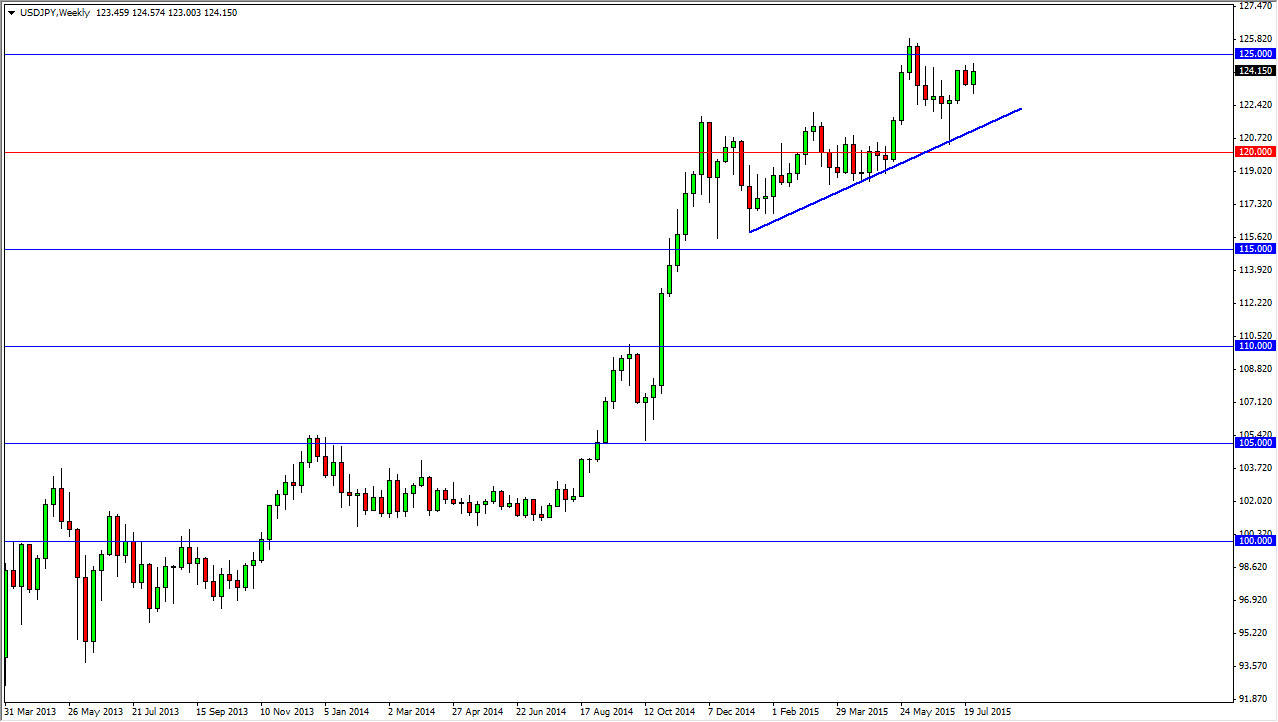

The USD/JPY pair had a slightly positive week for the last week of July, but as you can see we basically have been to change the attitude of this pair much. Even though it’s been very volatile, you can actually make an argument for an upward channel that we have been obeying. Because of this, I remain bullish of this pair, but I do recognize that we need to get above the 125 level in order to go much higher. Once we get above the 125 level that would indeed be a “buy-and-hold” type of situation. However, I don’t think it’s going to happen this month. I think we drift sideways while the market waits for liquidity to come back into the fray. After all, most of the large traders are away at holiday, and with that it makes sense that the market simply does nothing.

Buying dips

I think the best thing you can do is buy dips in this pair, as we should eventually break out. Once we do, you can to simply hang onto the core of that position, and add every time the market pulls back a bit. I have no interest in selling this pair, because I know that the Bank of Japan won’t have it. On top of that, I like the uptrend line and until we break down below there is really no reason to even think that it’s going to happen. I also have the 120 level drawn as a red line, and that for me is the “floor” in this pair.

Given enough time, I think that the market continues to go higher due to several different reasons, not the least of which is the fact that the Federal Reserve is going to raise interest rates. I think it’s simply a matter of time. However, you are going to have to be very patient during the month of August as the real money doesn’t come back until the last week or so.