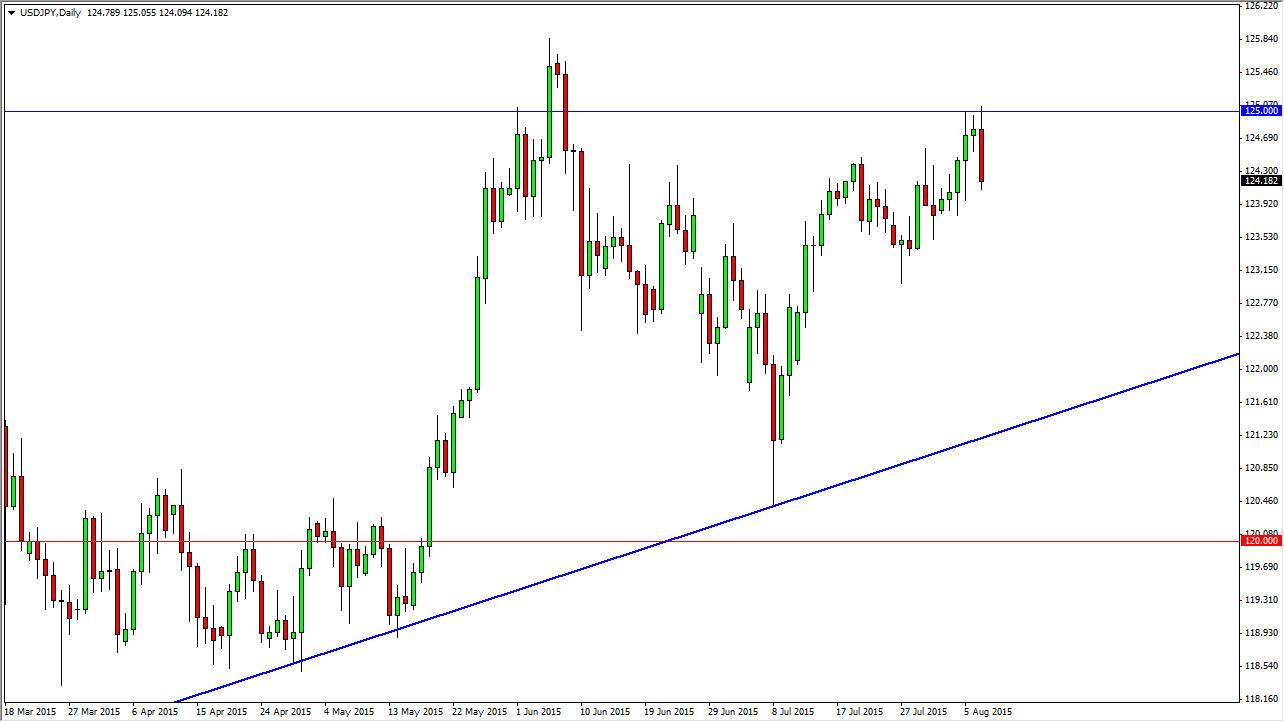

The USD/JPY pair tried to break out during the session on Friday, but found the 125 level to be far too resistive to continue going higher. While I do think that this market eventually breaks out to the upside, this simply means to me that we do not have quite enough in the way of momentum to break out quite yet. That’s not a big surprise though, because it is the wrong time of year to expect massive moves. I think that we will continue to dip from time to time, and that those movements should be thought of as “value” in the US dollar. I am expecting this market to drop a little bit from here, but eventually find support, probably somewhere near the 123.50 region.

Buying supportive candles

I believe that sooner or later we will have buyers stepping into this marketplace as the longer-term trend most certainly favors the US dollar, and there are a couple of fundamental factors that you will have to keep in mind. This pair tends to follow the industry differential of the 10 year notes between the United States and Japan, and those rates are widening ever so slightly.

The Bank of Japan continues to offer very loose monetary policy, and that should keep the Japanese yen fairly soft in general. At the same time, we all know that the Federal Reserve is probably going to raise interest rates at least once this year, and that of course puts in some bit of a bid for the US dollar in general. I do think that the Federal Reserve is going to be somewhat underwhelmed, but at the margin, you have to keep in mind that it’s expectation that drives the value of currency, and quite frankly the Bank of Japan is expected to be ultra-easy with its monetary policy for years to come. Even if the Federal Reserve disappoints, it’s only a matter of time before the buyers get involved again.