USD/JPY Signal Update

Last Tuesday’s signals expired without being triggered.

Today’s USD/JPY Signals

Risk 0.50%

Trades may only be taken between 8am and 5pm New York time only, and then after 8am Tokyo time later.

Long Trade 1

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 123.00.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

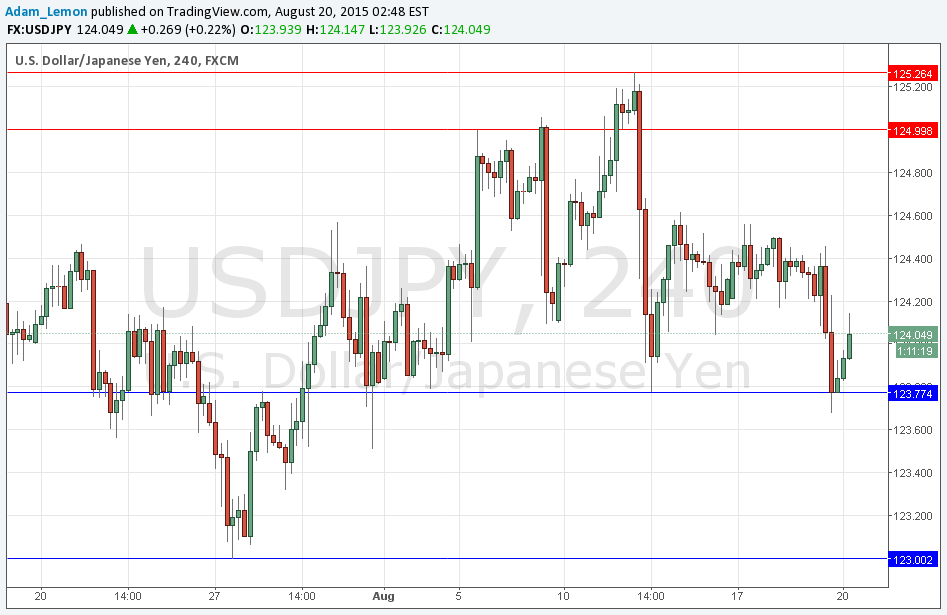

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next entry into the zone from 125.00 to 125.26.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/JPY Analysis

This pair remained extremely quiet until yesterday’s FOMC release, which was bearish for the USD and as such pushed the price of this pair down to support at 123.77. The FOMC did not move the price very much and the USD has bounced back, but that move back also has not been very strong. For this reason I am going to ignore 123.77 as support today and focus on the other levels I have previously identified, which are a long way away from the current price. It does not look like there is going to be a lot of good action here.

There is nothing due concerning the JPY. Regarding the USD, there will be a release of Unemployment Claims data at 1:30pm London time, followed by Existing Home Sales and the Philly Fed Manufacturing Index at 3pm.