USD/JPY Signal Update

Yesterday’s signals were not triggered and expired as none of the key levels were ever reached.

Today’s USD/JPY Signals

Risk 0.50%

Trades may only be taken between 8am and 5pm New York time only, and then after 8am Tokyo time later.

Long Trade 1

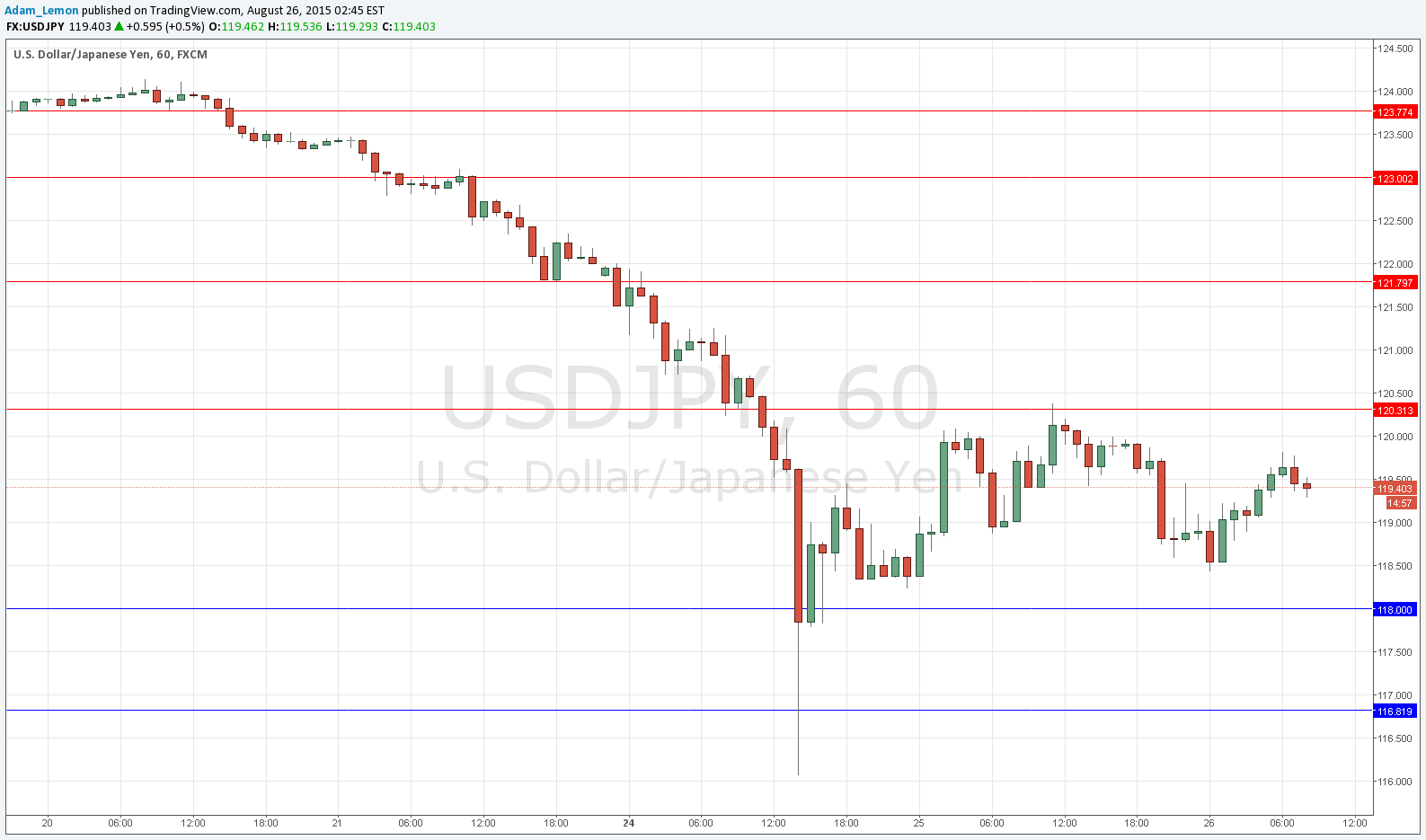

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 118.00.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 30 pips in profit.

Take off 50% of the position as profit when the trade is 30 pips in profit and leave the remainder of the position to run.

Long Trade 2

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 116.82.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 30 pips in profit.

Take off 50% of the position as profit when the trade is 30 pips in profit and leave the remainder of the position to run.

Short Trade 1

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 120.31.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 2

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 121.80.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

Although the largest move earlier in the week was in the Japanese Yen, which strengthened dramatically as a safe have, this pair seems to have found a new centre of gravity, consolidating at around the 119.00 level, with resistance a little above the psychologically key 120.00 level and support at around 118.00, As such the future direction is unclear. It should be remembered that this pair was largely going nowhere for quite a while until the recent sharp fall, and as long as there is no more global panic, it is likely that the Yen will not fall much further.

For the time being, longer-term traders might want to look at longs off the 118.00 level as a good trade if the pair is going to resume its very long-term upwards trajectory.

There is nothing concerning the JPY due today. Regarding the USD, there will be a release of Core Durable Goods Orders data at 1:30pm London time.