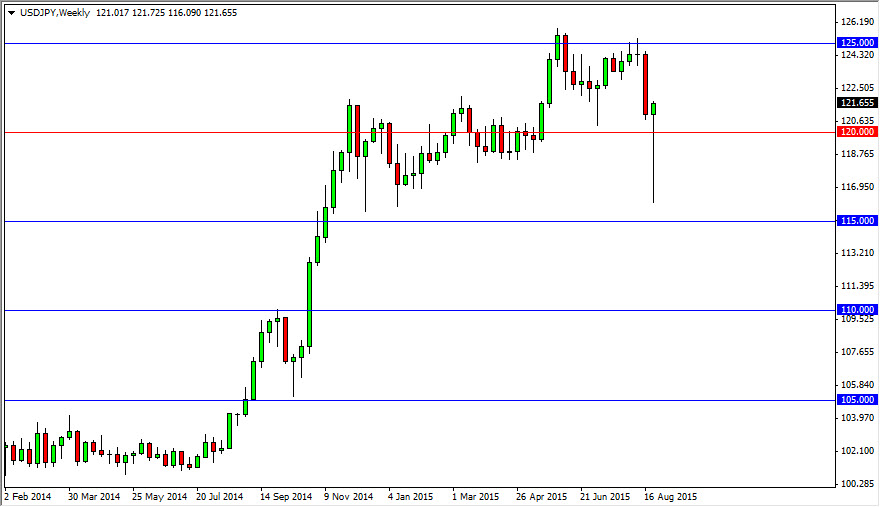

The USD/JPY pair has been in a nice uptrend for quite some time now. We did have quite a bit of volatility during the month of August, and as you can see the last weekly candle for the month of August featured a massive selloff down to the 116 level. This was based upon the markets believing that perhaps the Federal Reserve was not going to be able to raise interest rates this year. However, several announcements have come out since then that suggests the Federal Reserve may possibly still have room to move.

The GDP preliminary numbers that came out towards the end of the month turn this market around completely. The fact that we broke back above the 120 level suggests to me that there is still plenty of buying pressure underneath, and let us not forget that the Bank of Japan does not want this pair going lower. Granted, we have had quite a significant rise and the central bank would necessarily move immediately, but traders have to be aware of this.

Buying dips

I believe that buying dips in this pair going forward will be the way to go. I also recognize that the 125 level above is massively resistive, but it’s probably only a matter of time before we break out above there. After all, the massive selloff couldn’t even hang out for an entire week. With that, I think it shows just how much buying pressure there is underneath. That tells me that there’s some real resiliency to the uptrend, and if you look at the actual real body of candles, you can see that we are essentially still in the same up trending channel. Yes, we did break down below it but we couldn’t hold those losses for any length of time at all.

That being said, I am a buyer every time this market dips, if it shows any signs of support at all during the month of September. I don’t know if we can break above 125 during September, but I think we’re going to make a serious attempt to do so.