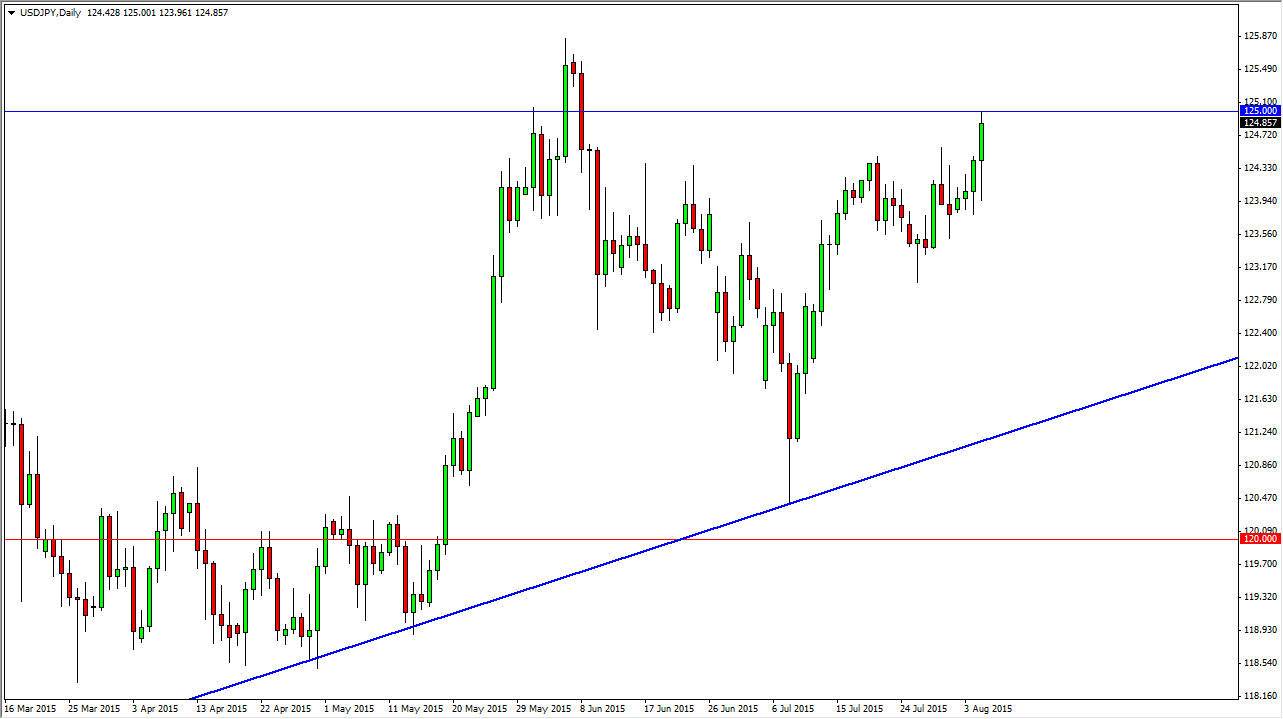

The USD/JPY pair initially fell during the course of the session on Wednesday, but found buyers below to turn things back around and form a rather positive looking candle as we slammed into the 125 handle. This is the gateway to higher levels as far as I can see, so therefore I am very interested in buying this pair as it looks like we have already made up her mind as to what we want to do before we see the Nonfarm Payroll Numbers on Friday. Because of this, I think that we will get a lot of volatility, but at the end of the day I think that this pair will eventually break out to the upside. I think pullbacks represent value in the US dollar, because the Bank of Japan will continue to work against the value of the Japanese yen in general.

I think that it’s only a matter of time before he break out and have more of a “buy on the dips” type of market, and with this I have absolutely no interest whatsoever in shorting this market. I know that the Federal Reserve is expected to raise interest rates later, and the Bank of Japan is light-years away from doing so.

Technical barrier

The 125 level is simply a technical barrier, and those do get broken eventually. Once we get above there, we should then reach for the 130 level, and then perhaps much higher than that. Even if we fell from here, I have no interest whatsoever in selling as long as we can stay above the 120 handle. There is an uptrend line, but there is also a massive amount of support at 120 based upon what we have seen recently. Ultimately, I think that it’s only a matter of time before we get buyers every time we fall. I think that this market will become more of a long-term move to the upside and this Nonfarm Payroll announcement could be the catalyst.