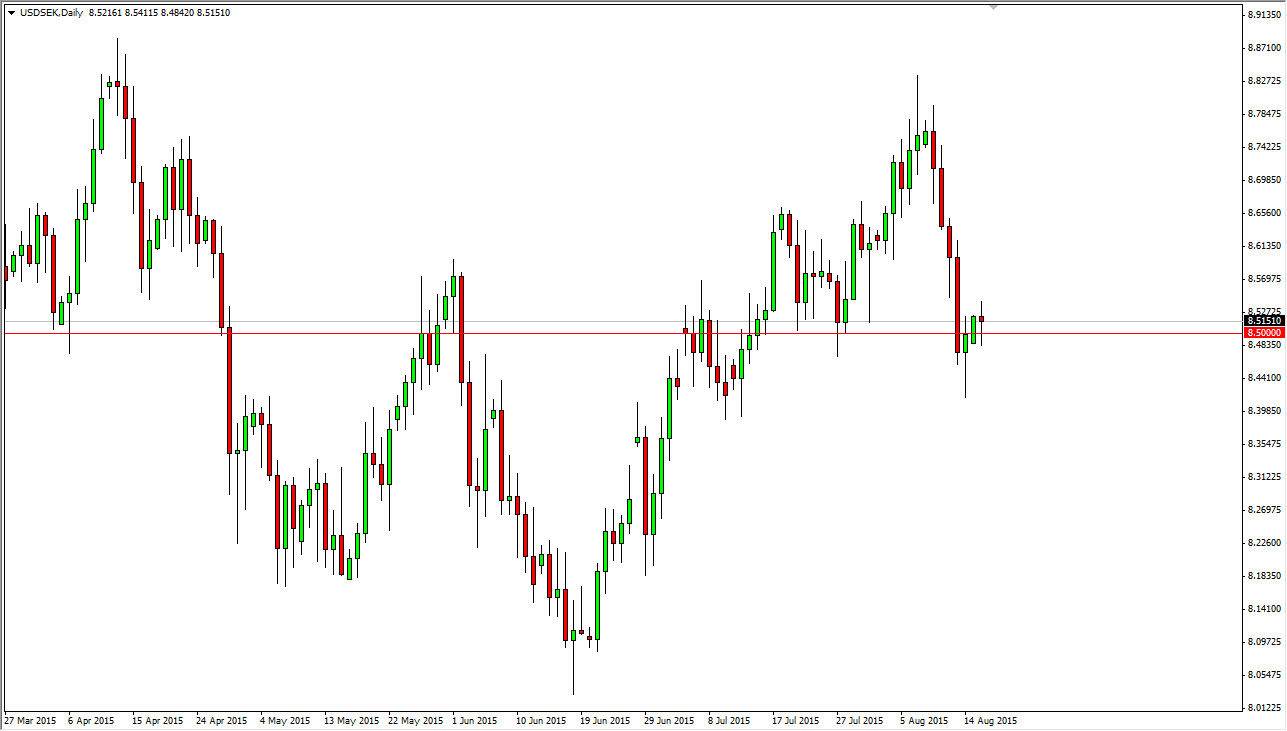

The USD/SEK pair initially fell during the course of the session on Monday, but found enough support near the 8.50 level to turn things back around and form a hammer. The hammer of course is very positive, so if we can break above the top of that I would be a buyer. What I really like is the fact that the 8.50 level is so large as far as a large, round, psychologically significant number is concerned. On top of that, we also had a nice hammer from Friday, and now it looks like we are ready to grind our way higher.

I know what you are thinking, the Swedish krona isn't exactly a currency that you play very often. However, it is a significant pair. It’s the smallest component of the US Dollar Index, but many people will avoid this pair because they don’t understand that it is a fairly liquid pair, as well as a relatively stable one. However, the truth of the matter is that the spread is fairly large and that is what scares a lot of newer traders away. However, you have to keep in mind that the PIP value is fairly small. In other words, it’s all the same as any other major or relatively liquid pair.

Buying breakouts and pullbacks

As long as we stay above the 8.50 level, I am more than happy to go long of this pair. We’ve had a nice move higher, followed by a very sharp selloff. The selloff of course isn’t something that can continue for any real length of time, because it was so brutal. This pair looks very healthy in general, and as a result I think that eventually we will build up enough momentum to break out above the recent high. However, keep in mind that the lack of liquidity between now and 1 September is going to be a bit of an issue. Once the buyers come back that we will have to pay attention but I think we should do quite well to the upside. On the other hand, if we did break down below the 8.39 level, I think at that point in time the markets first to fall apart.