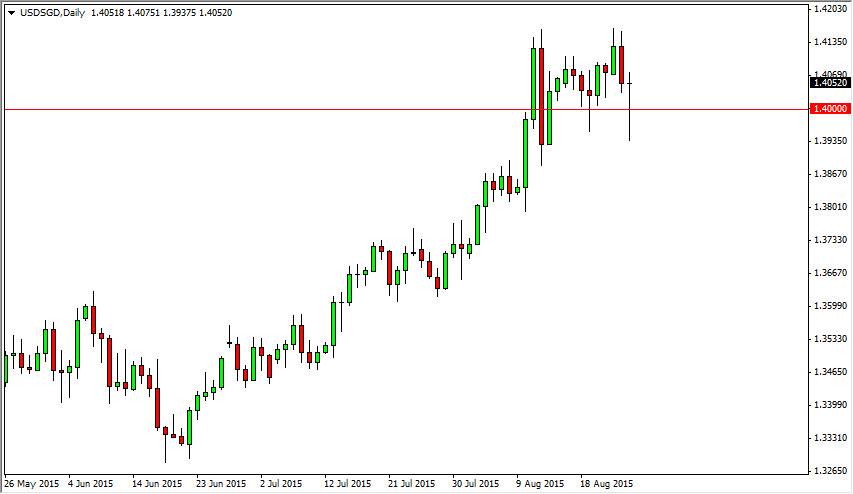

The USD/SGD pair fell initially during the course of the session on Tuesday, slamming through the 1.40 level at one point during the day. That being the case, the market found enough support below to turn things back around and form a hammer. The hammer of course is one of the most bullish candlesticks that you can see, and with that I feel that this market is ready to continue going higher. Keep in mind that the Singapore dollar is a currency that represents Asian growth as Singapore quite often will finance a lot of the larger construction projects.

Ultimately, the US dollar should continue to strengthen as long as the Asian economies remain soft. There are a lot of concerns coming out of different places like China, and as a result it makes sense if this pair continues to grind much higher. This is a marketplace that tends to go very steady, but you have to realize that the market requires quite a bit of patience. After all, it won't want to make an impulsive move, and you simply have to let the market do its own thing and continue to move in whatever direction that it’s going.

Buying dips

I believe that buying dips after this market rallies a bit will be the way to go going forward. After all, as I said this market tends to be very stable and it tends to favor longer-term grinds. Ultimately, I have no interest in selling this market, at least not until we get below the 1.38 level, which for me is the essential “floor” in this particular currency pair. I think that we are probably heading towards the 1.50 level given enough time, and as a result I see no reason whatsoever to think about selling at this point in time. As long as there is trouble in places like China, it’s almost impossible to imagine this pair falling with any real length of time or conviction.