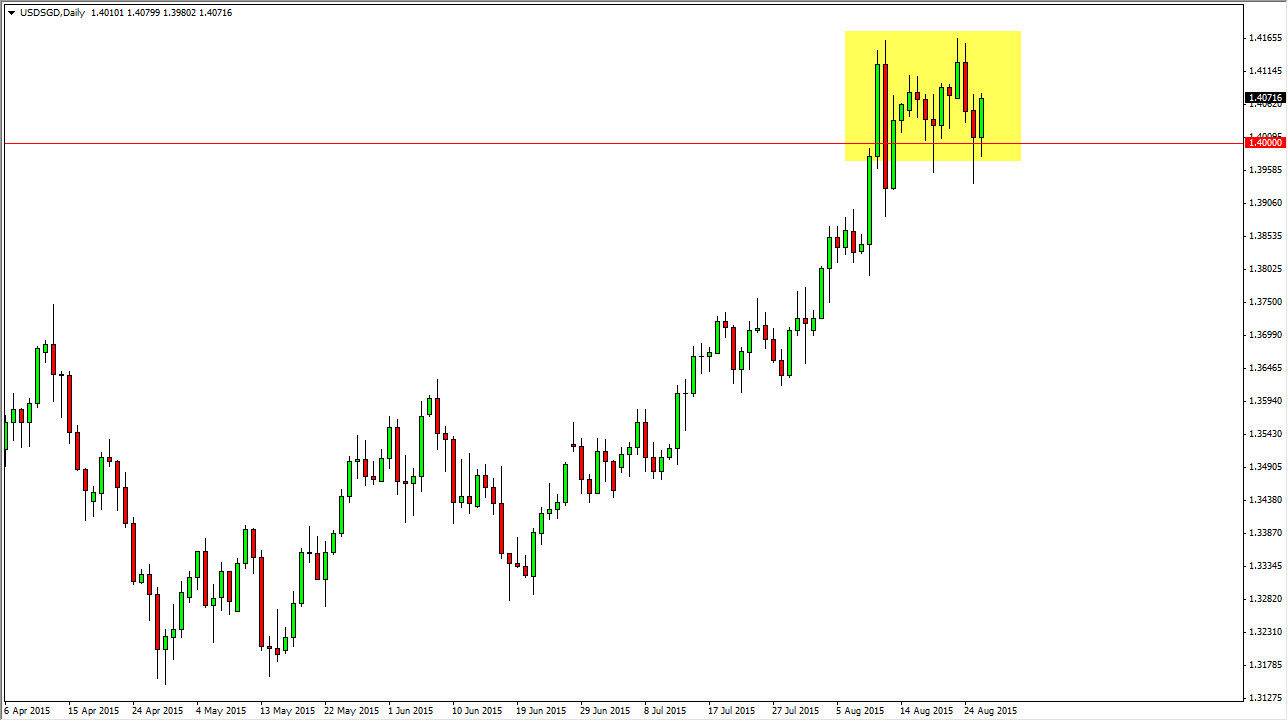

The USD/SGD pair initially tried to break down below the 1.40 level during the day on Wednesday, but as you can see we broke higher. In fact, at the end of the day we are testing the top of the hammer from the Tuesday session which of course is a very bullish sign. That should have buyers coming back into this marketplace in trying to push the pair to the 1.4160 level again. The Singapore dollar of course is a financing currency when it comes to construction and large projects in Asia, as Singapore is essentially known for its banking sector. This is a simple play on North American versus Asian economies at the moment, and as that is the result it makes sense that the US dollar continues to strengthen.

Buying dips

As long as we can continue to go higher, I don’t see any reason why you can't add to your position on the upside every time we pullback. After all, this is a grinding pair, and as a result it is something that you take your time to collect profits. This isn't a lightning fast pair, but I do enjoy trading it because it is something that you can truly invest in, not necessarily just scalp. High-frequency traders don’t necessarily get involved in this pair, so it does tend to move a very methodically.

With that being the case, I feel that as long as we can stay above the 1.39 level, there’s no reason to even think about selling. I think that we will eventually try to get as high as the 1.45 level, but that of course will take serious time as I said before, this pair does move quickly. That’s not to say that there are profits, you just have to be a patient and a more long-term oriented person to take advantage of these setups. However, I would say that one of the greatest lessons I ever learned involved shorting this pair years ago and picking up 700 pips, sometimes, it pays to be very patient. That’s especially true in this market.