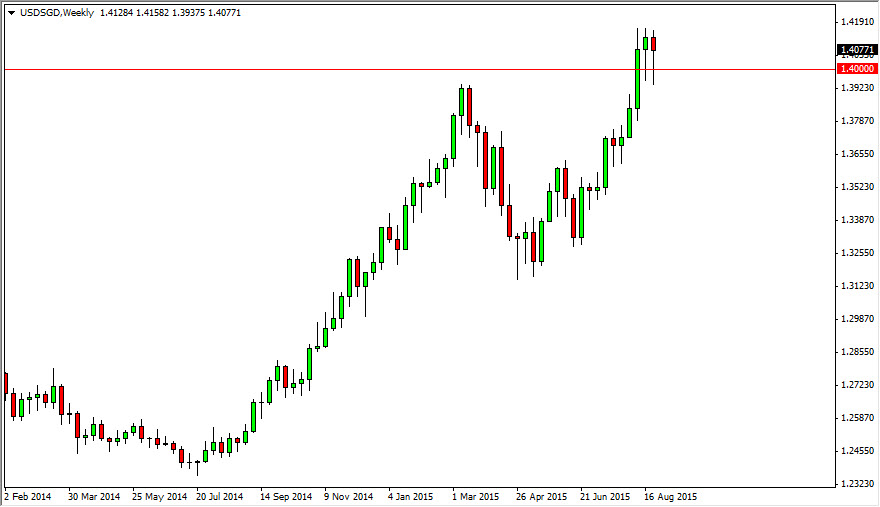

The USD/SGD pair fell the last couple of weeks during the course of the month of August, but as you can see found enough support at the 1.40 level to turn things back around and form hammers. Because of this, I feel that the 1.40 level will essentially be the “floor” in this market during the month of September, as we should continue to go higher. I believe that this market should probably reach towards the 1.45 level but keep in mind that the US dollar/Singapore dollar pair tends to be a market that grinds, and not necessarily explodes in a particular direction. With that, I feel that it’s only a matter of time before we go higher every time we drop but you have to be very patient. After all, the Singapore dollar tends to be considered a bit of a “safety currency” when it comes to Asia.

USA versus Asia

Asian economies have been slowing down, and quite frankly the market is concerned as China has to enter quantitative easing. While Singapore doesn’t immediately come to mind, keep in mind that Singapore is a banking nation, and as a result the Singapore dollar is often used as a proxy for investment in Asia in general. If China is slowing down a bit, and you would have to assume the places like Laos, Thailand, and Indonesia are doing the same. If that’s the case, demand for Singapore dollars will continue to fall as investment will dry up.

On the other side of the Pacific Ocean, you have the United States which is actually starting to show strength again. The GDP preliminary numbers that came out during the last week of August were much stronger than anticipated, and as a result it makes sense that money serve to flow back into the United States again as it is the sole growing major economy, the least of any significance at the moment.