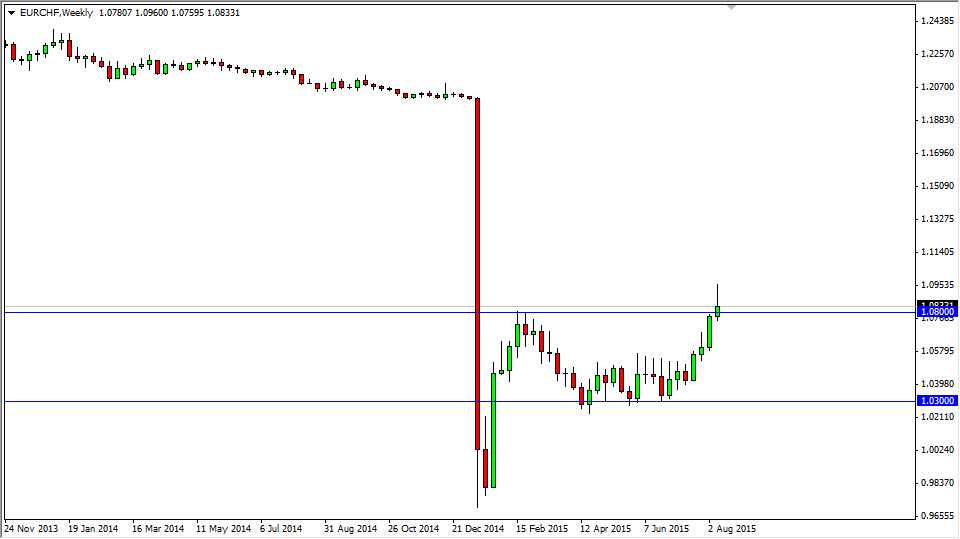

EUR/CHF

The EUR/CHF pair is one of the most interesting ones to me at the moment, civil because we have broken above the 1.08 level that I have seen such a massive resistance at. However, by the time the markets closed on Friday we ended up forming a bit of a shooting star for the weekly candle. I don’t necessarily think that this is a negative sign though, I think this just simply says that the market is going to pull back a little bit before finding pressure to the upside. I recognize that the 1.10 level is a large, round, psychologically significant number and therefore should cause a little bit of trouble, but at the end of the day I still feel that buying is the only thing that can be done. Sooner or later, we are going back to the 1.20 handle.

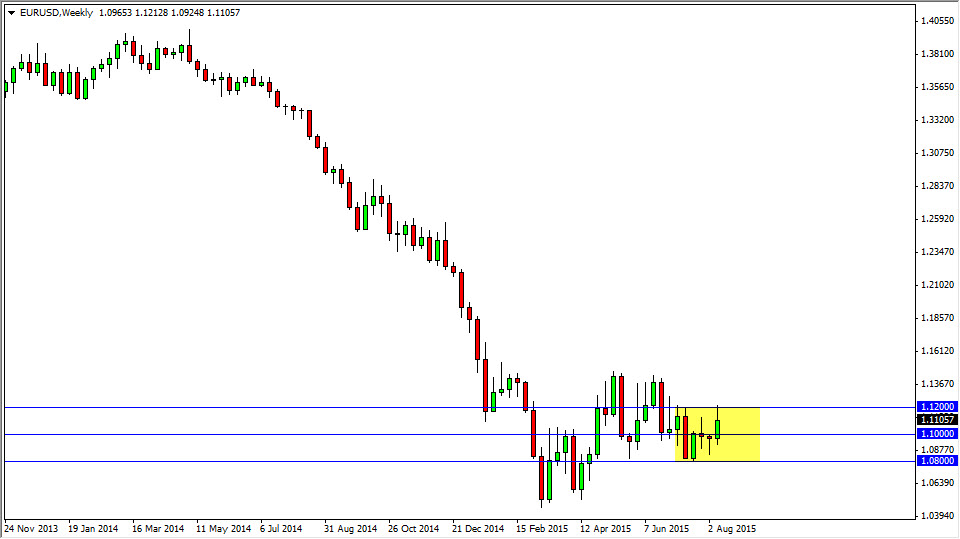

EUR/USD

The EUR/USD pair rose during the course of the week, slamming into the 1.12 handle. However, we did find a bit of resistance there so at this point in time I believe that we are going to continue to consolidate overall. I think that the 1.10 level is essentially “fair value” at the moment, so we will probably drift back towards that level. If we break down below there though, I think that the 1.08 level should offer plenty of support.

USD/JPY

Even though I’m very bullish of this pair, I recognize that forming a neutral candle at the 125 handle signifies that perhaps we are not quite ready to break out to the upside. With this, I think the pullbacks probably coming but I also recognize that there is a significant uptrend line just below. I feel that it’s only a matter time before we find buyers on any pullback, and therefore remain bullish. However, I think we are going to have to drop a little bit from here in order to build up the momentum necessary to finally break out.

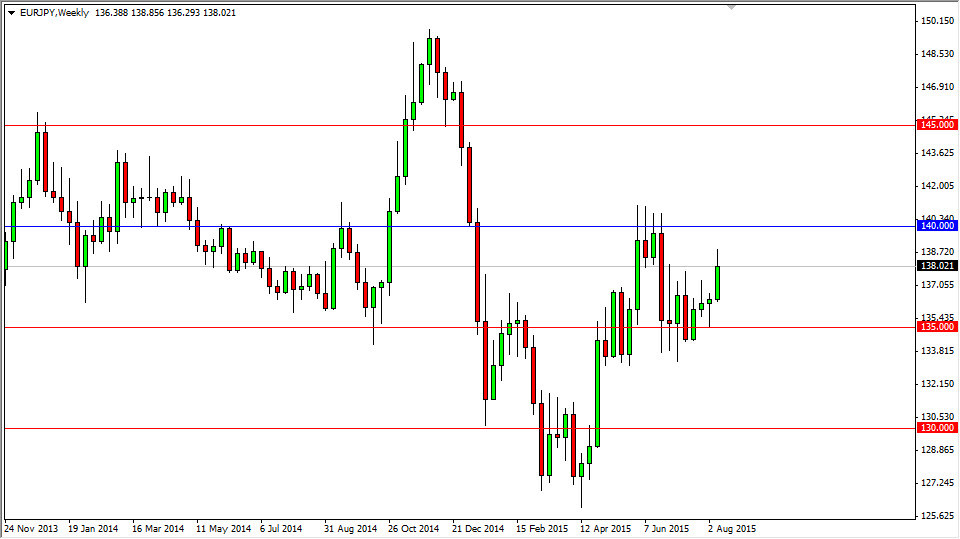

EUR/JPY

The EUR/JPY pair broke higher during the course of the week, and even cleared the 138 handle. However, we did find a little bit of resistance there so I feel it’s going to happen is that we are going to pull back a little bit from here, build up momentum, and then go higher. Ultimately I think we are trying to work our way towards the 140 handle. It isn’t going to be an easy move though.