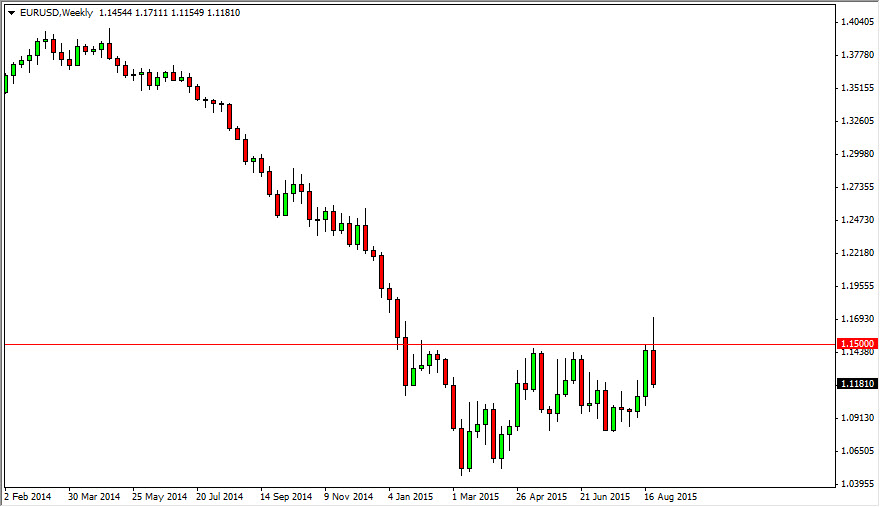

EUR/USD

Looking at the EUR/USD pair, we broke down during the course of the week, clearing the 1.15 level. While this should have been a sign that we were going to go much higher, the market turned back around and shot way below the 1.15 handle. In fact, we went below the 1.12 level in this shows just how much resistance as above. Because of this, I think that we will continue to see selling pressure in the market.

USD/CAD

The USD/CAD pair broke higher during the course of the week initially, but turned back around and form a shooting star. The shooting star suggests that perhaps we are going to drop back towards the previous resistance zone, which extends from the 1.30 level to the 1.28 level. With this, a pullback at this point in time the finds a supportive candle at the end of it could be a nice buying opportunity. In the short-term though, expect this market to pull back.

EUR/CHF

The EUR/CHF pair initially tried to rally during the course of the week, but found far too much in the way of resistance above the 1.08 level, causing the market to fall and form a shooting star. With this, the market looks like it’s a bit confused, and this is especially true considering that the previous candle was a hammer, and the one before that was a shooting star. Because of this, I feel that this market will continue to consolidate between the 1.07 level on the bottom and the 1.09 level on the top.

USD/JPY

The USD/JPY pair fell significantly during the course of the week but found enough support at the 160 level to turn things back around and form a hammer. Because of this, the market looks as if it is going to be one that you can buy every time it pulls back, as we should then head towards the 125 level given enough time. I have no interest whatsoever in selling this market and believe that we will continue to go higher.