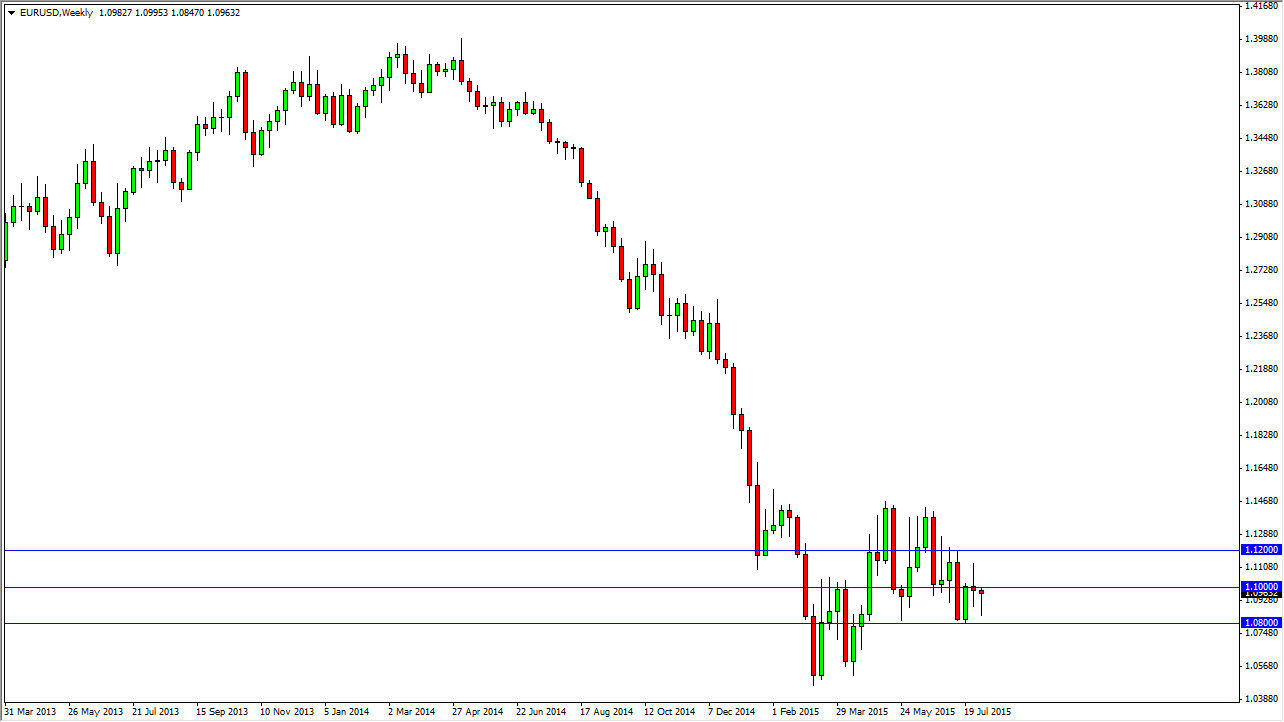

EUR/USD

The EUR/USD pair fell initially during the course of the week, but regained of most of the losses by the time we closed up shop on Friday. Ended up forming a hammer, which of course is a bullish sign. However, that was preceded by a shooting star, which means consolidation. With that in mind, I am actually staying away from this pair this week, as I think there will be easier ways to make money in the markets. Quite frankly, the only thing I think you can count on a short-term volatility.

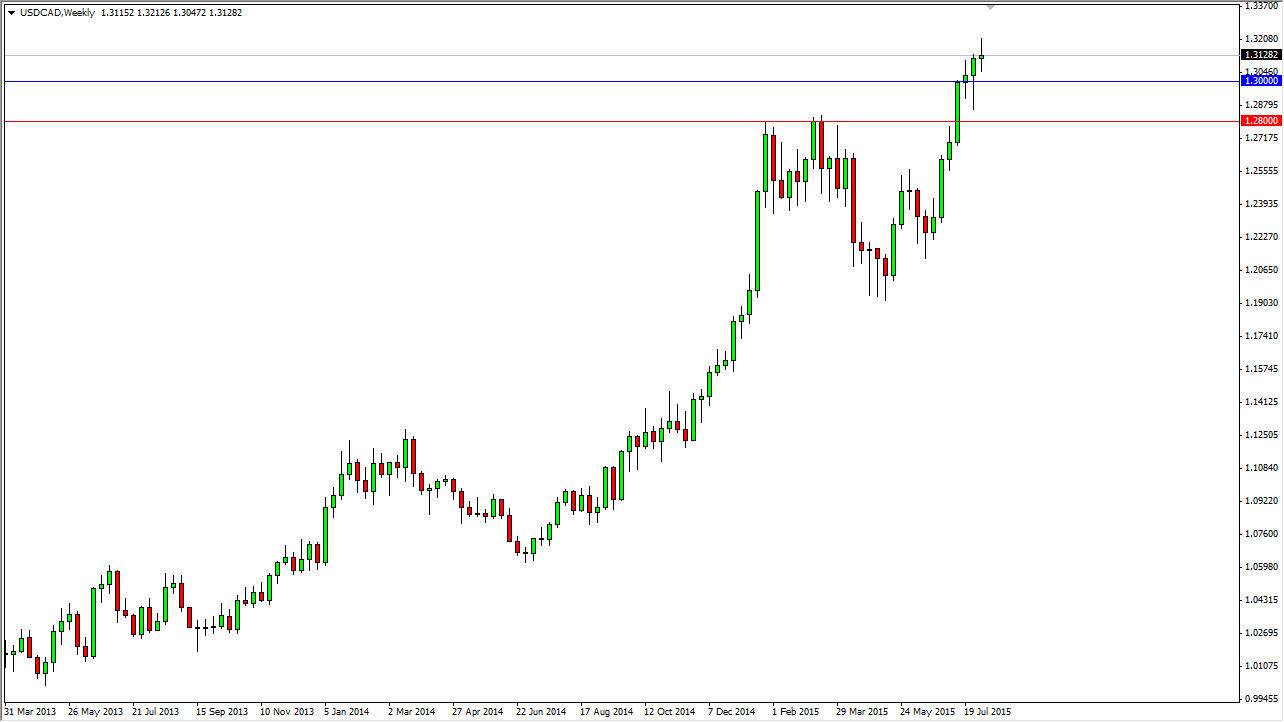

USD/CAD

The USD/CAD pair went back and forth during the course of the week, but as you can see ended up forming something akin to a shooting star. Because of this, we may get a little bit of a pullback but quite frankly I see massive amount of support between the 1.30 level and the 1.28 level below there. At this point in time, I think if we see a pullback, this will prove itself to be a buying opportunity in the end. With that, I am going to be patient and wait for supportive candles in order to start going long again.

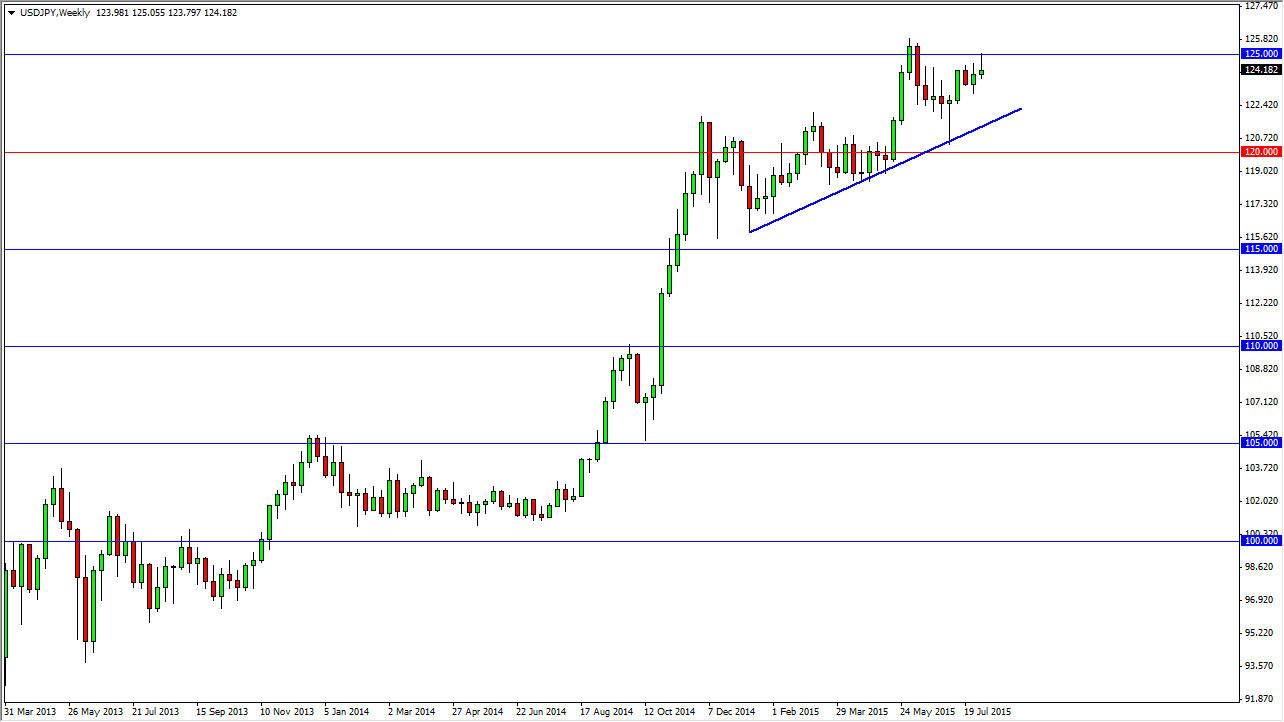

USD/JPY

The USD/JPY pair tried to break out to the upside during the week, but as you can see the 125 level was far too resistive. We ended up forming a shooting star which of course is bearish, but I believe that the uptrend line still will be heavily influential in this market. Pullbacks that could be coming should be thought of as “value” in the greenback, and I will be buying supportive candles as they appear. In general, this looks like a week that is going to be more or less about momentum building in a low liquidity environment.

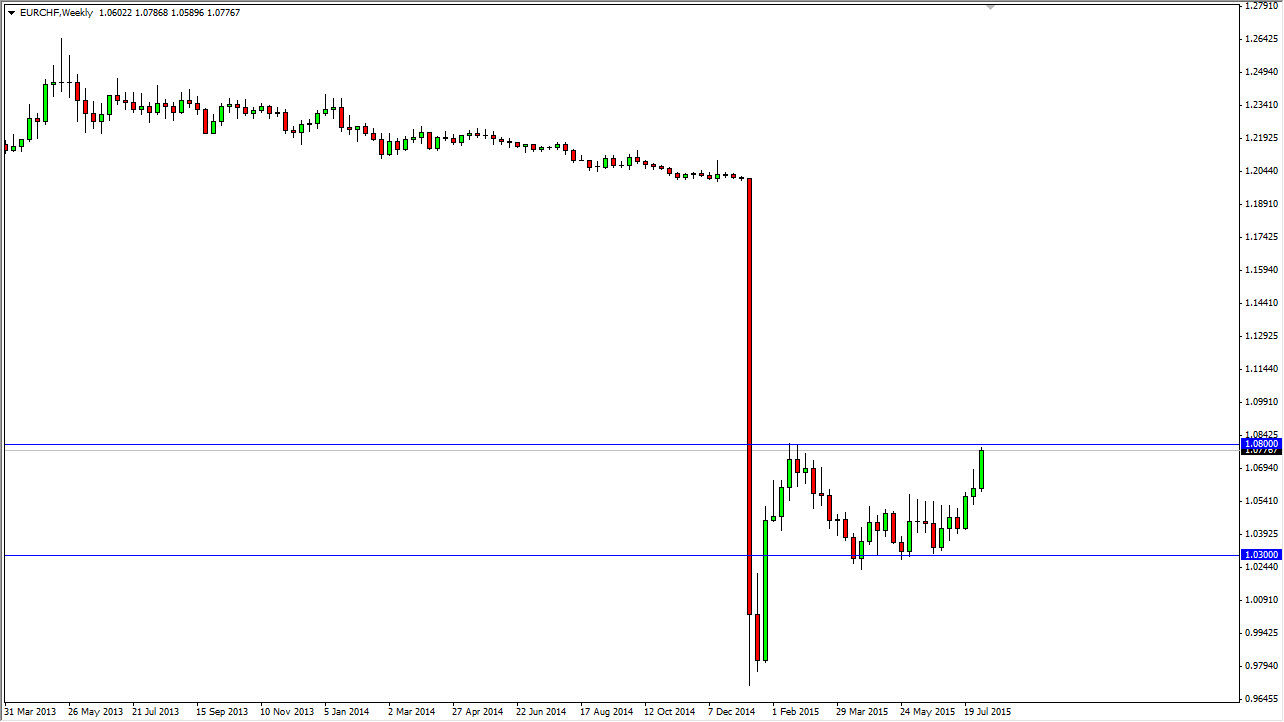

EUR/CHF

This is probably the one clear-cut case that I see right now. It’s simple in this particular market, if we can stay above the 1.08 level for 24 hours, I would be a buyer and aiming for much higher levels, possibly even as high as 1.20 again. I really like this pair, if I get the move that I need. However, you will have to be patient.