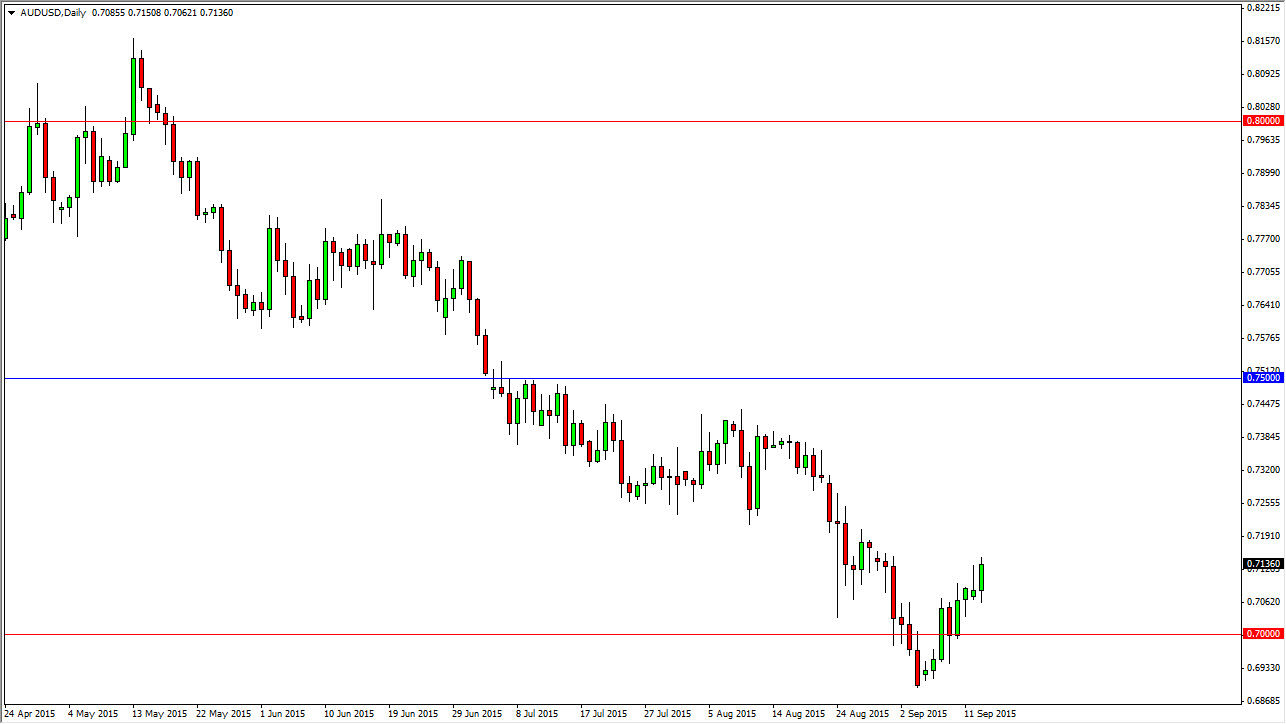

The AUD/USD pair broke higher during the course of the session on Monday, and even managed to break above the top of the shooting star that had formed on Friday. This of course is a very bullish sign, and as a result I think this market may try to go a little bit higher from here. However, I see quite a bit of resistance near the 0.72 level, and as a result I think that this will lead to a decent selling opportunity. Obviously, we have been in a very strong downtrend for some time now, and as a result I feel that it is far too dangerous to go against the massive bearish pressure that we see in this market.

Top of that, the gold markets haven’t exactly been strong, and the two markets do tend to be correlated. I think that the gold markets are going to remain soft for a while and as a result I think that the Australian dollar is going to suffer. On top of that, you have to keep in mind that the Aussie is highly sensitive to the metals markets in general, and that includes non-precious metals such as copper which has been falling rather significantly for quite some time.

Selling rallies

I continue to sell rallies in this market, although I am not have the right resistive candle to do so quite yet. I think that even if we break above the 0.7250 area, which I see as the top of the closest resistance, there is far too much in the way of bearish pressure all the way to the 0.75 handle to consider buying the Australian dollar was any sense of confidence. I believe that the first signs of resistance will send the buyers running, and offer value when it comes to the US dollar, which has been one of the most favored currencies in the world. With this, I think that eventually the downtrend will continue.