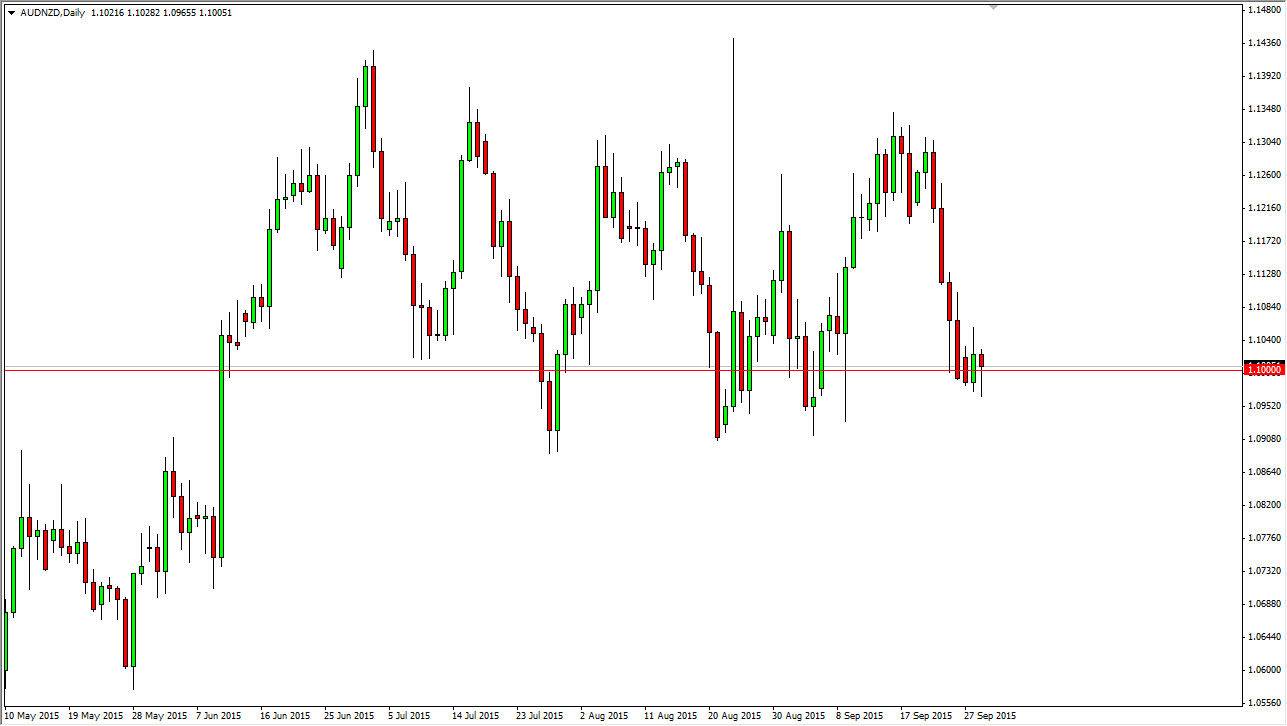

The AUD/NZD pair fell initially during the course of the day on Tuesday, but found quite a bit of buying below the 1.10 level to turn things back around and form a hammer. The hammer of course is a pretty significant positive sign. After all, it is considered to be one of the more bullish signs that you can see on the candlestick chart, and it happens to be what formed during the session on Tuesday. On top of that, the hammer formed at the 1.10 level, a perfect round number. After all, this is a number that could attract a lot of traders as it is such an obvious place for trades to be placed.

As you can see, we have tested this area all the way down to the 1.09 level, which leads me to believe that this is essentially a support “zone.” That zone of course means that it is a powerful support area that could in fact keep this market afloat for the longer term. I believe that the Australian dollar will continue to do better than the New Zealand dollar based not only on this chart, but a couple of other reasons as well.

Gold markets

It’s very likely that gold markets are going to go higher given enough time, and as a result it should pull the Australian dollar higher over time as well. After all, the 210 the move in congruence, as Australia exports so much gold to the rest of the world. However, copper markets will of course push the Australian dollar higher given enough time, as it looks like that market could bounce.

On top of that, I believe that the New Zealand dollar being quite a bit less liquid than the Australian dollar will continue to keep that market down, simply because volatility affects it in a much more violent way than the Aussie. I think that if we can break above the top of the range for the session on Tuesday, the market could very well find itself trying to work its way back to the 1.13 handle.