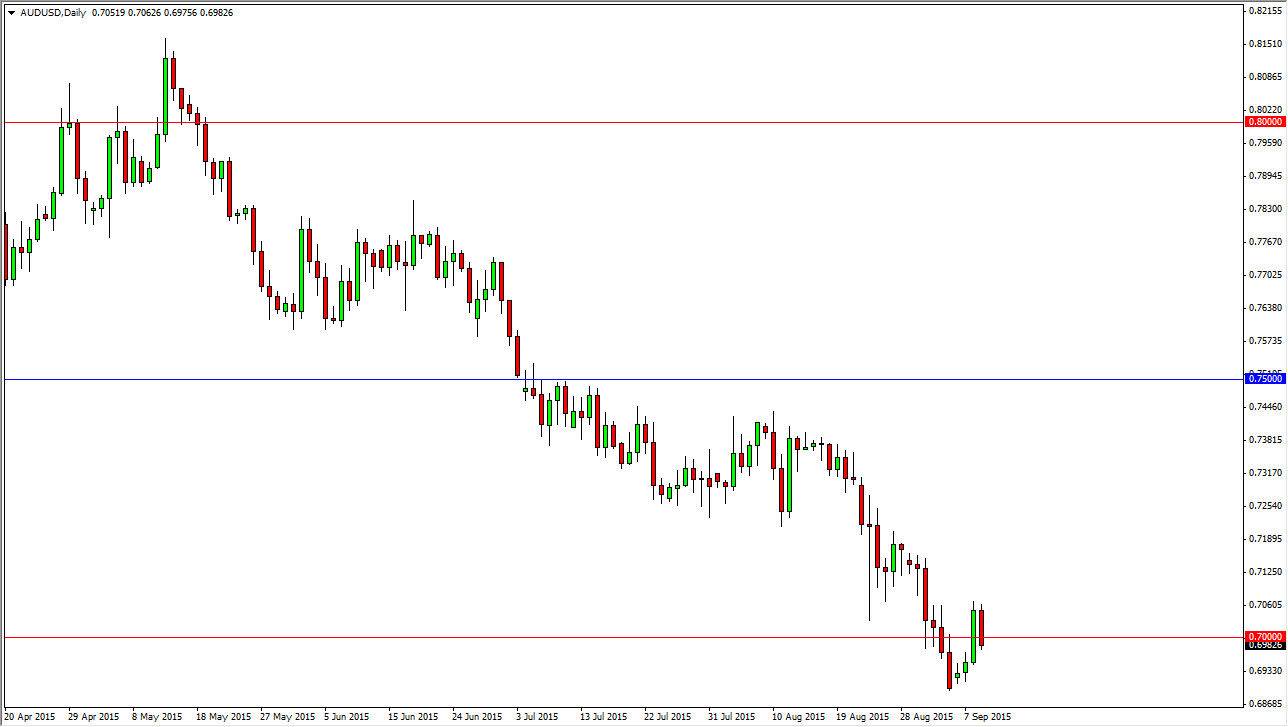

The AUD/USD pair fell significantly during the course of the session on Wednesday, breaking below the 0.70 level. With this, it is more than likely going to be bearish yet again, and the fact that the Australian dollar has been so soft for so long suggests that we should continue to see sellers jump into this market every time we rally. I think that the trend is very strong and very obvious, and the entire world looks at it as such.

I believe that rallies will continue to find sellers going forward, and I see a massive amount of resistance all the way to the 0.72 level. Any type of resistive candle is enough of a reason to sell. Ultimately though, it’s not until we get above the 0.75 level that I would consider buying this pair. Quite frankly, it is just far too negative of a market to consider buying at this point in time.

Continued negativity

I believe that this market will show continued negativity, especially considering that the gold markets look very soft at the moment. This should continue to see quite a bit of selling pressure on the Australian dollar, and with this I believe that we will reach towards the 0.69 level, and then lower than that given enough time. Even if we rally from here, I feel that it will simply represent value in the US dollar, and with the struggles going on in Asia, it makes sense that the Australian economy suffers as they are massive exporters of raw materials to Asia, especially when it comes to the construction industry, which is certainly suffering.

As a general rule, the US dollar is anticipated to be the “safety currency” for the world. As long as there are struggles out there, the US dollar will have a bit of a bid. On top of that, the US is one of the few areas as far as major economies that seems to be standing on its own, so it makes sense that the US dollar continues to strengthen.