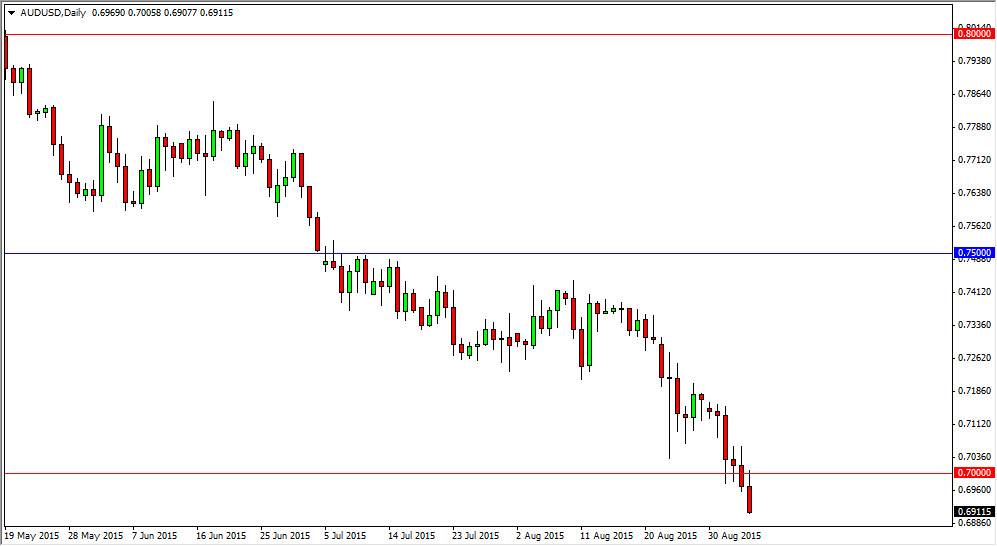

The AUD/USD pair initially tried to rally during the session on Friday, but failed at the 0.70 level as it showed significant signs of resistance. This was an area that was previously supportive, so it makes sense that it should now be the exact opposite. Ultimately, that is a large, round, psychologically significant number, so it makes sense that the market will pay attention to it. We fell from there though, but having said that it appears that the market will continue to go lower. We close the very lows of the candle, so that of course is a very negative sign as well.

Commodity markets of course aren't doing any favors for the Australian dollar as it is highly leveraged to commodities in general. Gold is especially influential on the Aussie, but there are a lot of different factors going on right now in the marketplace.

Asian softness

Asian markets and economies in general look very soft in general, and as a result there will be less demand for gold and copper, as well as other minerals that come out of the Australian continent. With that, it makes sense if this pair continues to drift lower as the relative safety of the US dollar of course will be attractive. I feel that this market will reach towards the 0.68 handle given enough time, and then eventually down to the 0.65 level. With this, I sell on a break down below the bottom of the candle, and of course any rally that show signs of weakness as the Australian dollar has been beat up so severely. This is a strong trend, and a break down below the 0.70 level is of course a very negative sign.

At this point in time, I have no interest whatsoever in buying the Australian dollar, as the 0.72 level is massively resistive. In other words, I feel that the market probably shows resistance all the way from the 0.70 level, and towards the 0.72 handle. With that, it looks like a very significant barrier that we will not break anytime soon.