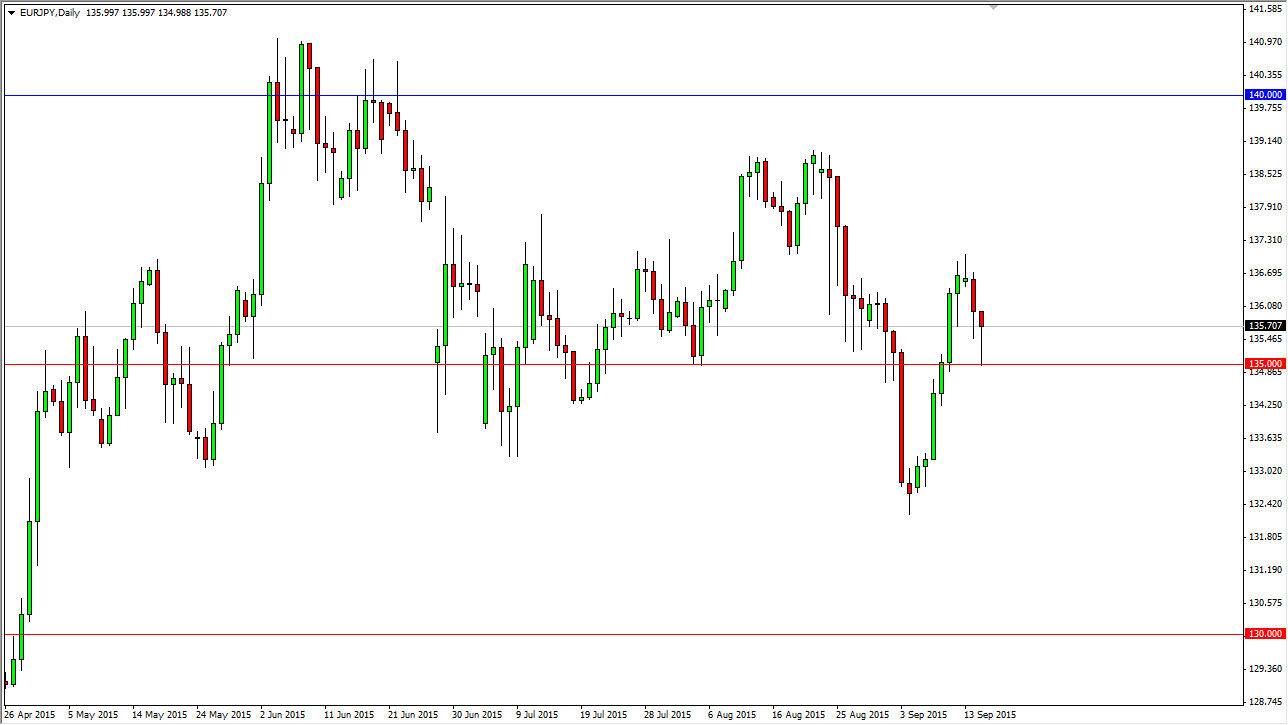

The EUR/JPY pair initially fell during the course of the session on Tuesday, crashing into the 135 handle. The 135 level below appears to be supportive though, as we managed to bounce enough to form a hammer. This hammer of course is a very strong bullish signal, and as a result I am very interested in buying this pair if we can break above the top of the hammer. At that point in time, I would anticipate that the market would have to tangle with the 137.50 level, and then eventually the 139 handle. Above there, the 140 level above is massively resistive as well. In the meantime, it looks as if the market should continue to go higher given enough time. That doesn’t mean that is can it be an easy move though, and quite frankly I anticipate a lot of volatility between here and there.

The significance of 135

I believe that the 135 level is significant, and although we have broken down below it recently it is pretty important as it is an area that will attract a lot of attention based upon the fact that it is a large, round, psychologically significant number. What I also recognize is that forming a hammer instead of breaking down below it and continuing to drop to the 133.50 level as we have in the past tells me that the buyers have suddenly gotten a lot more aggressive. With that being the case, I do think that we are going higher given enough time.

With this, I believe that you can also look to all the other Japanese yen related pairs, which all look basically the same. In other words, this may not even be about the Euro, it might be about the Japanese yen. With this, I believe that the market will go higher and I have no interest whatsoever in selling. Even if we broke down below the 135 level, I would simply ignore that and sit on the sidelines.