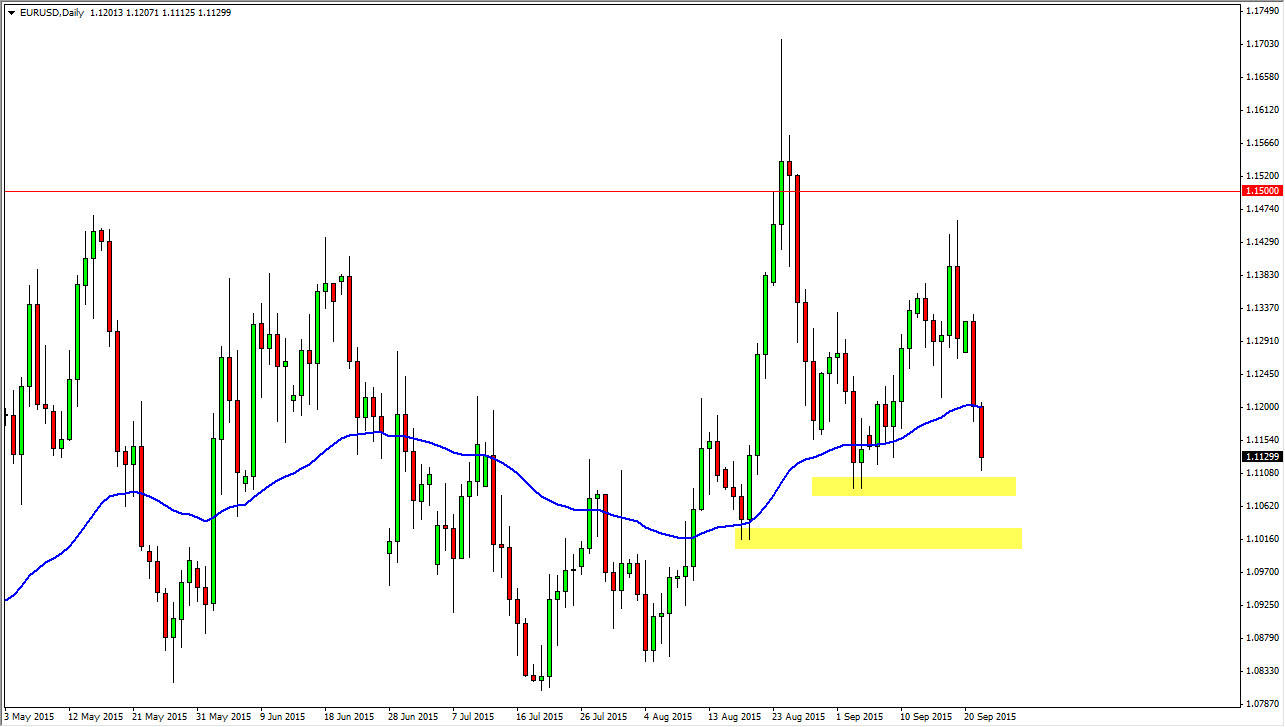

The EUR/USD pair fell again during the Tuesday session, and broke well below the 50 day exponential moving average. This is a longer-term EMA that a lot of longer-term traders will follow. Because of this, I’m sure that there will be more sellers getting involved in this market. However, there are support levels just below that can move this market as well, so quite frankly I think the one thing you can count on is volatility at this point in time.

The 1.11 level just below is supportive as you can see marked by the yellow box. With that, the market will probably try to find support there, but I feel that more than likely we will probably find real support down at the 1.10 level. At that point in time, I think that any selling opportunity will have been lost.

Short-term traders only

Looking at this chart, the first thing I think of is the fact that longer-term traders will struggle to hang onto positions with any real length. With that, the market should continue to go back and forth quite a bit, and of course the recent volatility based upon the Federal Reserve not raising rates would be the biggest contributor to this now. With that, and the fact that the PMI numbers come out above Germany and France today, I think there could be a little bit of volatility added due to that as well. After all, the European indices all fell, and the DAX suddenly looks very vulnerable. With that, it could be a sign that more money is going to flow into the United States and out of Europe, and that of course will drive this pair lower.

However, the 1.10 level will of course offer quite a bit of support due to the fact that is a large, round, psychologically significant number. With that, I believe that the matter what happens we will have buyers in that area. With this, it’s more than likely going to be a market that you will have to trade off of short-term charts, meaning that you will have to be very quick to take profits.