EUR/USD Signal Update

Last Tuesday’s signals expired without being triggered as the price did not hit 1.1108 that day.

Today’s EUR/USD Signals

Risk 0.75%

Trades may only be taken between 8am and 5pm.

Long Trade 1

• Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.1108.

• Put the stop loss 1 pip below the local swing low.

• Move the stop loss to break even once the trade is 20 pips in profit.

• Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

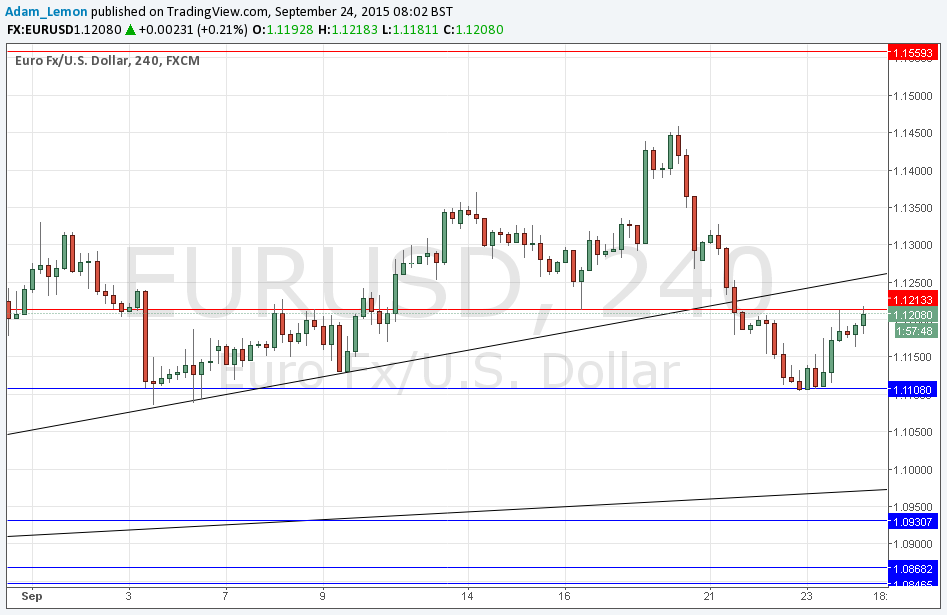

• Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of the broken supportive trend line currently sitting at around 1.1255.

• Put the stop loss 1 pip above the local swing high.

• Move the stop loss to break even once the trade is 20 pips in profit.

• Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

EUR/USD Analysis

I saw 1.1108 as good probable support and yesterday this level held and provided a bullish turn almost to the pip. This upwards move has been stalling this morning at 1.1213 which is a previous inflection point and swing low acting as local resistance. This may have already provided the high of the day, but a return to a level higher at the broken trend line, which is now fairly confluent with the psychological level of 1.1250, will probably be a better bet. Below the current price, there is no reason why 1.1108 won’t act as good support again.

Broadly speaking, this pair really is not going anywhere, just up and down in a range.

Regarding the EUR, there will be a release of German IFO Business Climate data at 9am London time, followed by Targeted LTRO at 10:15am. Concerning the USD, there will be a release of Core Durable Goods Orders and Unemployment Claims at 1:30pm. The Chair of the Federal Reserve will be speaking at 10pm.