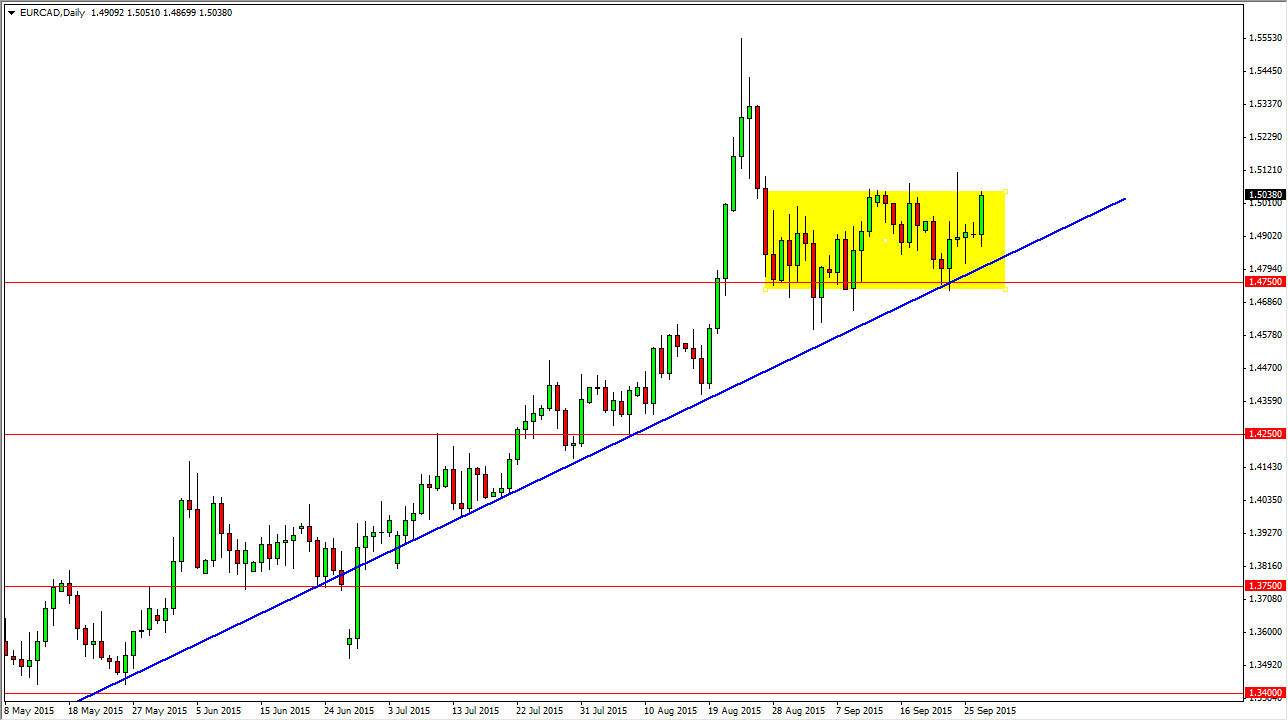

The EUR/CAD pair broke higher during the course of the session on Monday, as we continue to see buyers step in and pushes the market higher. However, we are still within the consolidation area that we have been in for some time now, with the 1.4750 level below being the supportive area, and more importantly the 1.5050 level being resistance. With this, I feel that a break out is somewhat imminent, and we should then reach towards the 1.55 level given enough time. Pullbacks at this point in time will more than likely have to deal with the uptrend line that has been relatively reliable, and any type of supportive candle would be reason enough to start going long.

The candle of course closed towards the very highs of the day, and that tells me that more than likely we will have a bit of a continuation of bullishness for the session today. Short-term charts may offer the buying opportunities that we should see. I will look to short-term charts in order to find the entries, and I believe that selling at this point in time is going to be absolutely impossible until we break down below the 1.4750 level.

Sideways, yet bullish

Lately, we have seen this market go back and forth during the course of the last several weeks, so having said that it’s very likely that the market is simply trying to build up enough momentum to reach the highs that we had made near the 1.55 handle. This isn’t exactly uncommon, as the markets will need to build up enough momentum to finally break above that significant layer of resistance.

However, if we break down below the 1.4750 level, it is not only show a significant breakdown of support on the horizontal line, and as a result it would be bearish. However, we also have the uptrend line that will also be broken as well, so having said that it is a bit of a “double negative” type of signal. At that point I would have to be a seller.