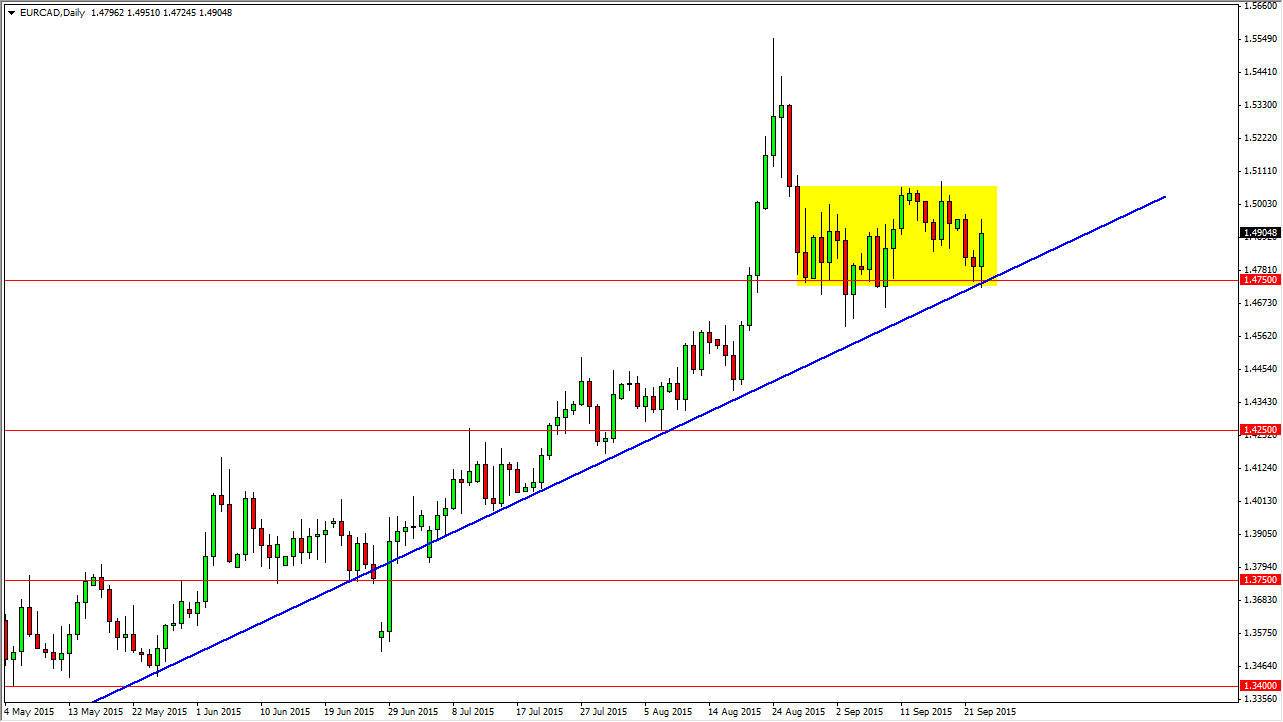

The EUR/CAD pair fell initially during the session on Wednesday, but obviously found support right at where the pseudo-uptrend line ended up forming. With this, and the fact that the 1.4750 level has been supportive lately, it is not much of a surprise to me that the market bounced. Quite frankly, I think that we will probably continue to go higher, perhaps heading to the 1.50 region in the short-term, perhaps even going higher than that if we do get a little bit of momentum. This isn’t necessarily a reflection on the strength of the Euro, but perhaps the weakness of the Canadian dollar. With that, it’s probably only going to be a matter of time before the Canadian dollar falls against the US dollar, and that will be the signal that this pair should go higher. We should continue the longer-term uptrend, even though the Euro has more than enough of its own issues.

Oil markets

Oil markets look as if they are starting to roll over again, and although we do have plenty of support just below, the reality is that the current pricing in the WTI Crude Oil market suggests that perhaps the market is ready to fall. If it does, you can anticipate that the Canadian dollar will lose value overall against most currencies. That of course will include the Euro, although I would be the first person say that the USD/CAD pair is probably going to move much stronger to the upside than this one right away. However, if you are trying to avoid some of the volatility associated with the US dollar, you can play crosscurrents type of trading pairs such as the EUR/CAD pair.

This pair will absolutely take off if the Euro continues to find buyers and pushes closer to the 1.15 level against the US dollar. With that being said, the simple analysis is that the Canadian dollar is simply soft, and beyond that try not to over think this situation.