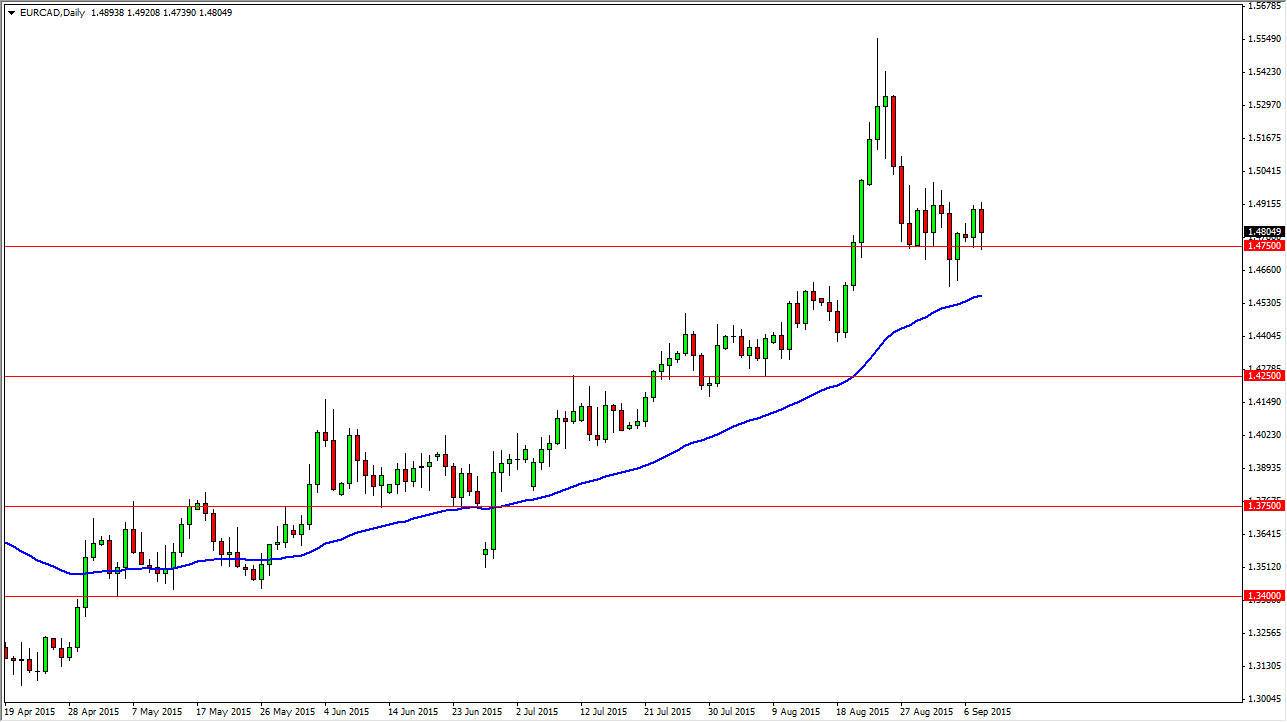

The EUR/CAD pair fell during the day on Tuesday, but found support at the 1.4750 level. Because of this, I believe that this market will find buyers here soon, and as a result it’s only a matter of time before it pulls back towards the 1.50 level. After all the Euro has seen a bit of a reprieve against most currencies, and the Canadian dollar of course has been rather soft in general. Keep in mind that the Canadian dollar is very sensitive to the price of oil, and although it is rising, it is far from a strong market at this point in time.

Just below, I see that the 50 day exponential moving average is offering support. I believe that between the 1.4750 level, and the 50 day exponential moving average, it’s very likely the buyers are going to get involved. With this, I am a buyer of supportive candles on short-term charts. I think that the longer-term traders will simply hang onto this trade, as there’s no reason to think that things are going to get any better for the Canadian dollar.

Big news today

The Bank of Canada has an interest rate announcement today, and of course a statement. That statement will be parsed by traders around the world looking for hints as to what the Canadian central bank will do next. Quite friendly, the Canadian economy has been very soft as well prices simply do not do much to prop up The Great White North. Ultimately, it’s probably only a matter of time before we start reaching towards the 1.55 level again, which of course was the recent high that this market had seen. With this, there is plenty of room to the upside and therefore this is one of my favorite positions to be involved in at the moment. However, do not expect explosive moves, I think we are simply going to grind our way higher as the market continues to punish the Canadian dollar.