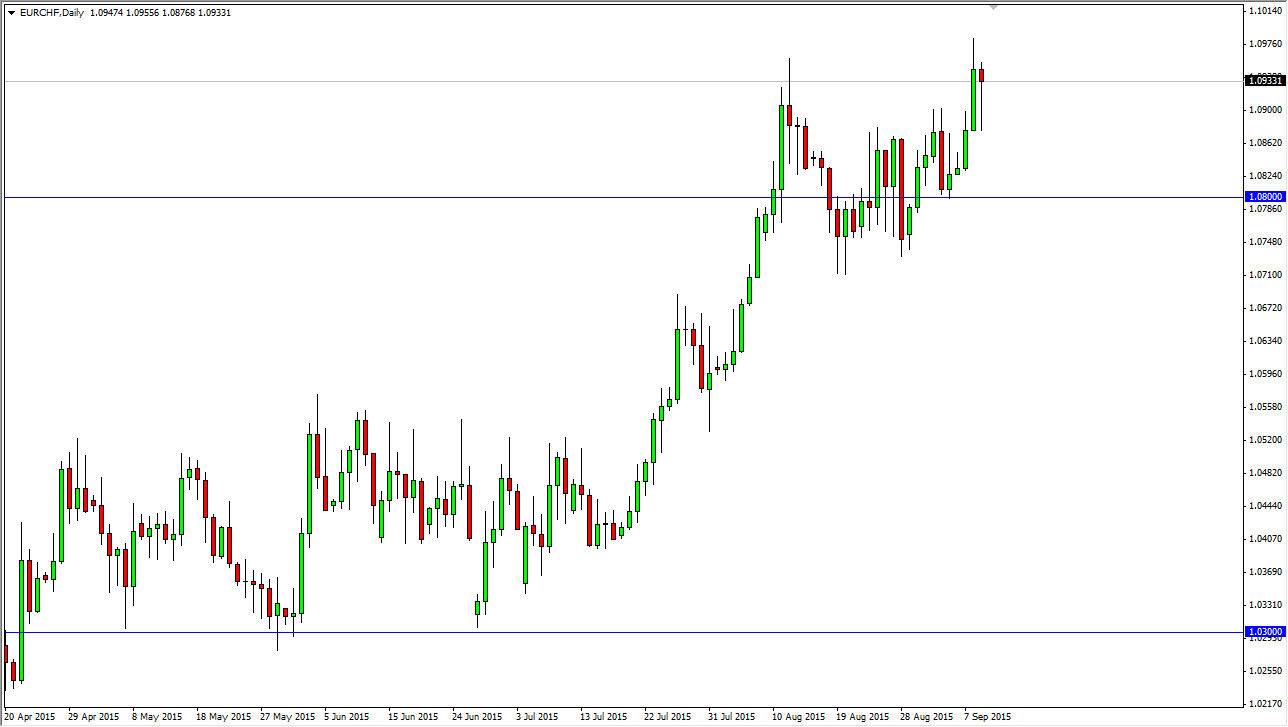

The EUR/CHF pair initially fell during the course of the session on Wednesday, but found enough support below to turn things back around and bounce massively. Because of this, we ended up forming a strong looking hammer, and that means that we should continue to see quite a bit of bullish pressure. A break above the top of the hammer is in and of itself a buying signal, but also a sign that we should continue to simply go higher. I think pullbacks continue to offer buying opportunities, and short-term charts can be used in order to enter the market. I have no interest in selling this market, because unlike many others, there is central bank interference.

Swiss National Bank

The Swiss have been working against the value of the Swiss franc lately, and in fact it appears according to financial reports to be working against the value of the Swiss franc in this pair specifically. Because of this, the market should continue to show quite a bit of bullishness overall, and every time that we pullback it should be looked at as “value” in the Euro.

At this point in time, I think that the 1.08 level is massively supportive, but at the end of the day I believe that the 1.07 level below is even more supportive. I think that as long as we can stay above those areas, this market should eventually try to break towards the 1.10 level, and then eventually the 1.20 level which would be essentially a “round-trip” when it comes to the move after the massive selloff that we had happen in the marketplace after the Swiss National Bank abandoned its currency peg against the Euro.

Regardless of any reasoning, we are most certainly in an uptrend and it appears that the market seems to be simply wanting to go higher. For me, that’s enough and that’s all I need to know. I am a buyer, and not interested in selling at this point in time.