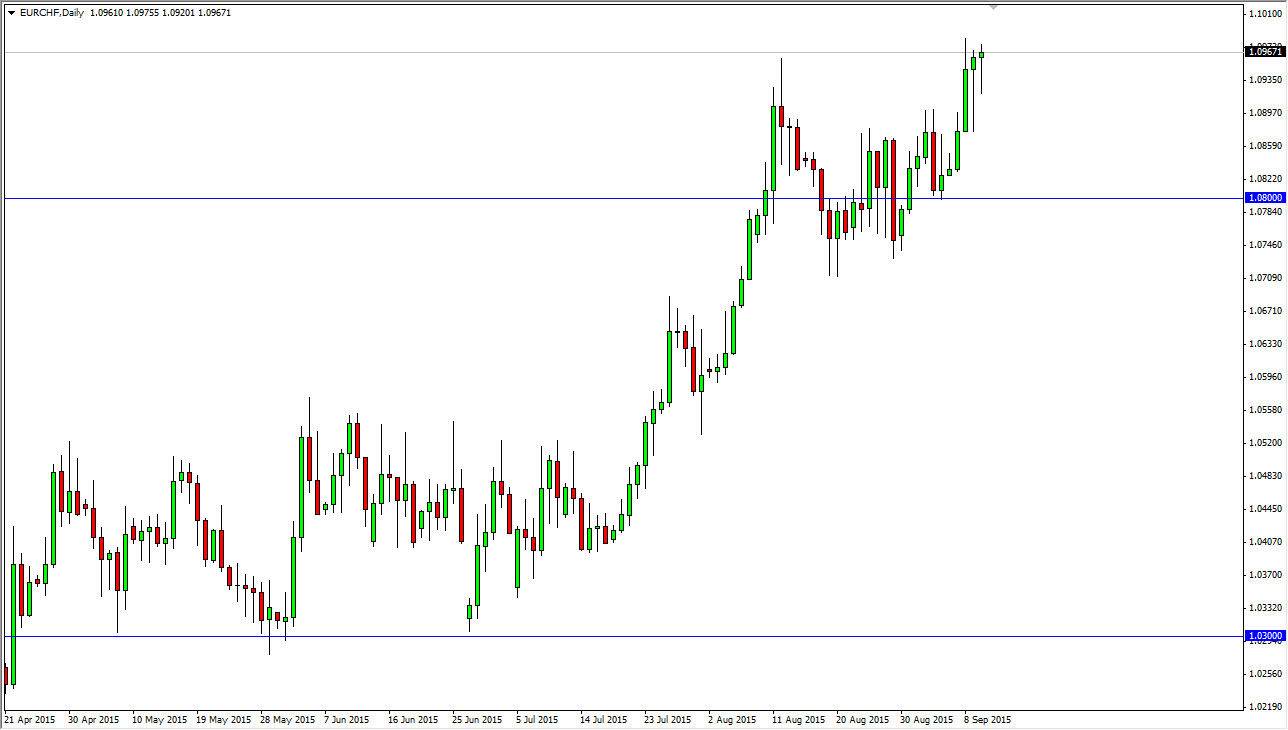

The EUR/CHF pair initially fell during the course of the day on Thursday, but found enough support near the 1.09 level to turn things back around and form a hammer. This hammer suggests that there are buyers below, but at the end of the day I think that this is simply going to be a continuation of the uptrend that we’ve seen for some time. I feel that this market is trying to build up enough momentum to break above the 1.10 level, which of course is a large, round, psychologically significant number. With that, it’s probably only a matter of time before we break out above the 1.10 level and then reach towards the 1.20 level.

Keep in mind that the market melded down after the Swiss National Bank eliminated its long-standing currency peg at the 1.20 level. It now appears that the market is going to take back all of those losses given enough time, and I believe that moving above the 1.10 level is the beginning of this long process.

Swiss National Bank

It has recently been revealed that the Swiss National Bank has been working against the value of the Swiss franc, especially against the Euro. This will more than likely send this market to much higher levels and of course offer support on every pullback. The shape of the hammer of course looks very strong, and as we have formed one on both Wednesday and Thursday, the buyers still look very much in control of this market as far as I can see.

I do recognize that it is going to take a significant amount of momentum to break out above the 1.10 level. Because of this I feel that several pullbacks may happen between now and then, but ultimately the winners will be the buyers in this market. I have no interest in selling this market as long as we can stay above the 1.07 level, and I believe that most of the market feels the same way.