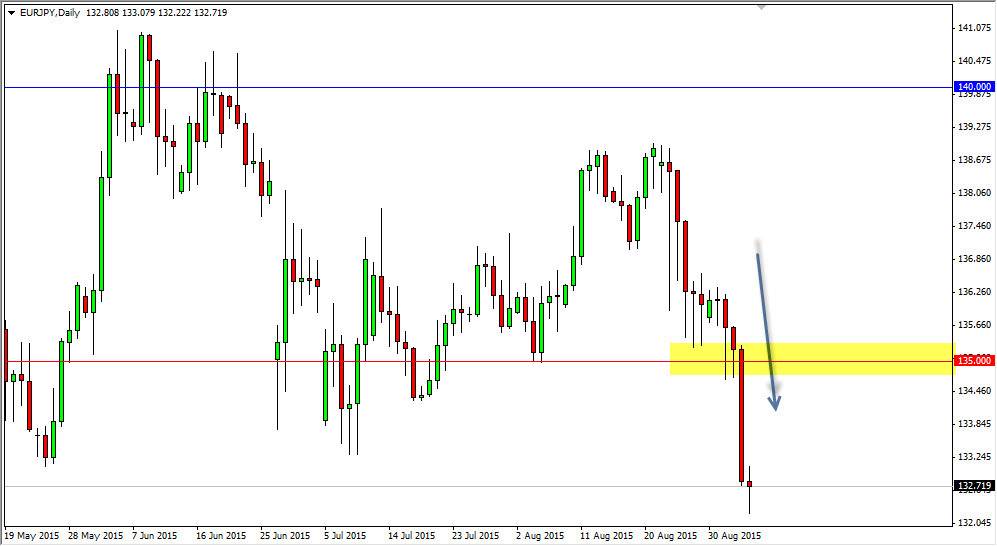

The EUR/JPY pair initially fell during the session on Friday in reaction to the jobs number, which of course missed in the United States. This is a pair that is very sensitive to risk appetite in general, and as a result it makes sense that the market fell right along with the stock markets. However, I also believe that the fact that we formed a hammer after breaking down suggests that we may get a little bit of a bounce after a significant fall. That makes sense, but I am not willing to buy this as I believe that there will be quite a bit of resistance above. Any resistive candle after rallies for my money is a selling opportunity as this market certainly looks broken.

135 level is increasingly important.

I see the 135 level as being very important, as it is previously supportive, and now looks to be resistance. I think that a rally to that level will find quite a bit of selling pressure, as the Euro continues to fail. Ultimately though, if we break down below the bottom of the hammer that’s an even more bearish sign, and I feel that the EUR/JPY pair will then head to the 130 handle given enough time. That is of course a large, round, psychologically significant number, and of course will attract a lot of attention by participants in the marketplace.

Pay attention to the stock markets in general, because they often will lead where this pair goes. Risk in general tends to run all one-way, and this pair is a great barometer for that. In fact, I quite often what uses pair to decide what I want to do about commodity trades as well. It just simply shows whether or not money is willing to be invested at the moment, as money flows from Japan to the European Union. With that being said, I do think that eventually we see lower prices.