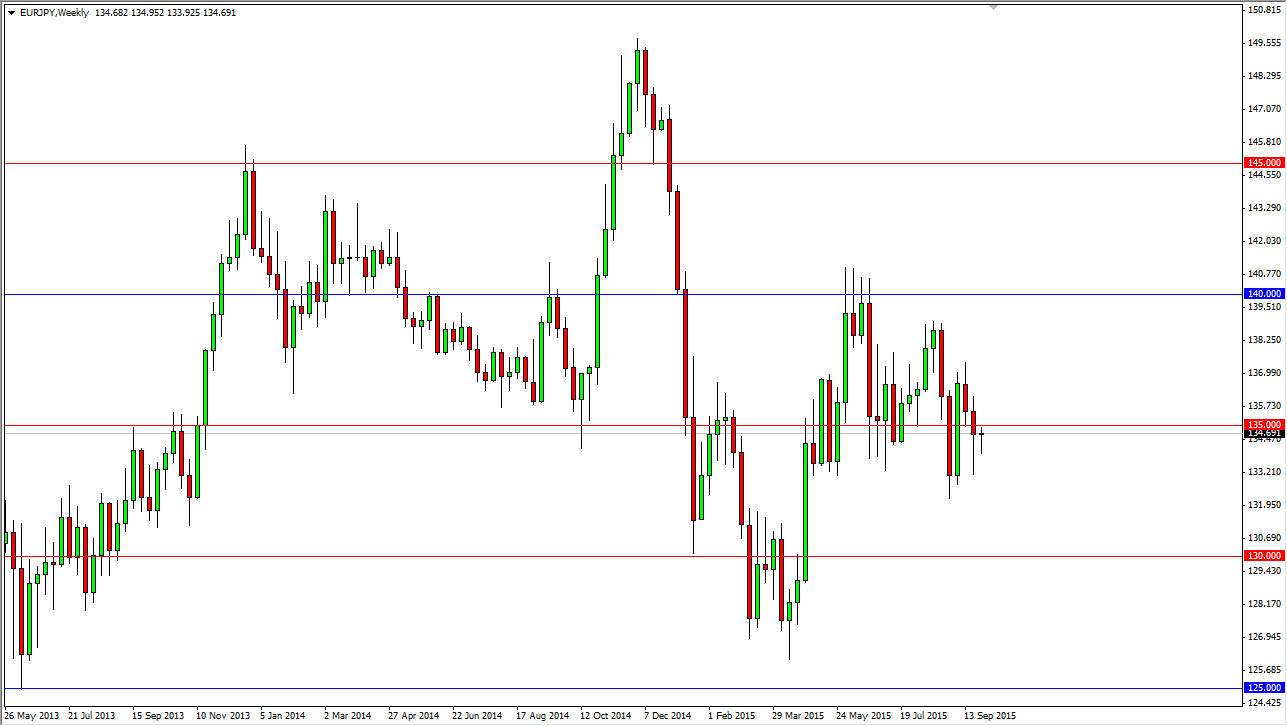

The EUR/JPY pair initially fell during the course of the last couple of weeks, but you can see that we bounce every time we drop. I believe that the 135 level is a bit of a focal point in the moment, but eventually we could continue to go much higher. I would anticipate that this market should chop around overall, but ultimately this pair should go back towards the 137 handle. I think the pullbacks continue to offer value, as this is a market that is well supported just below current levels, especially near the 134 handle.

This pair does tend to react to risk appetite in general, so pay attention to the stock markets overall. If they show signs of strength, this pair should go higher as per usual. That doesn’t mean that it’s going to be the easiest move, but ultimately I do think that this market will be relatively positive for this pair.

Massive support below

When you look at this chart, you can see that there has been massive support below current levels, especially near the 134 and 133 levels. Above the 135 handle I feel there are enough buyers to continue pushing this market back to the 137 handle, and then eventually the 139 handle. If markets in general go down and start to show risk appetite, this pair should go back to the 139 level sometime this month.

This is one of those pairs that you should be paying attention to when it comes to the overall attitude of the markets, as a breakdown in risk appetite should send this market lower, and vice versa. After all, this is a good way to play the currency markets as a proxy for overall economic health and vitality worldwide. In fact, there is a high correlation between this pair and the S&P 500, so keep an eye on both markets, as one will often lead the other. At this moment in time though, I would have to believe that there is quite a bit of buying pressure below, and that keeps me wanting to go long overall.