The EUR/USD pair fell significantly during the session on Monday, as the US dollar continues to be favored by the currency market at the moment. While the Federal Reserve did not raise interest rates last week, the reality is that they suggested global economies and markets will continue to be very volatile, keeping them from feeling comfortable enough to raise interest rates.

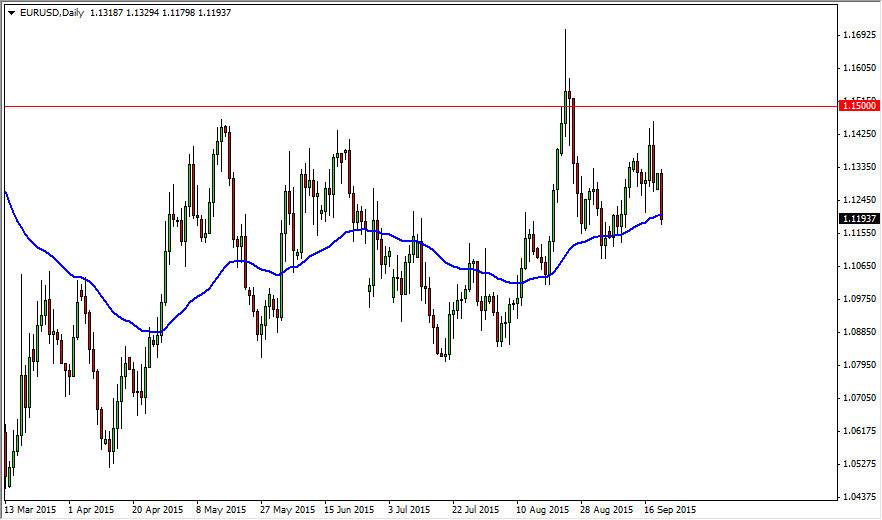

With that being said, we are testing the 50 day exponential moving average, which of course offers dynamic support. However, I think that it’s only a matter of time before we break down a little bit lower and reach towards the 1.11 level. This is an area that was supportive just a couple of weeks ago, and therefore I think the buyers will remember the area. I have no interest whatsoever in buying this pair until we get a supportive candle, and as a result I will look for short-term selling opportunities.

The significance of 1.15

At this moment in time, there seems to be a significance found at the 1.15 level in the form of a massive resistance barrier. If we can break above there, I feel that the trend will have changed completely, and quite frankly it would not surprise me to see that happen eventually. In the meantime though, the markets are digesting the fact that the Federal Reserve is concerned in general. However, there does come a point where interest-rate differential comes back into play, and the US dollar will continue to be a zero interest currency.

In the meantime though, expect a lot of volatility and downward pressure, I believe though that there is a “floor” near the 1.10 level, so I would be rather surprised to see this market break down below there. If it does, we will more than likely reach down towards the 1.08 level, and of course I would have to rethink the entire thesis. Regardless what happens, the one thing you can count on is a lot of choppiness and back and forth type of action.