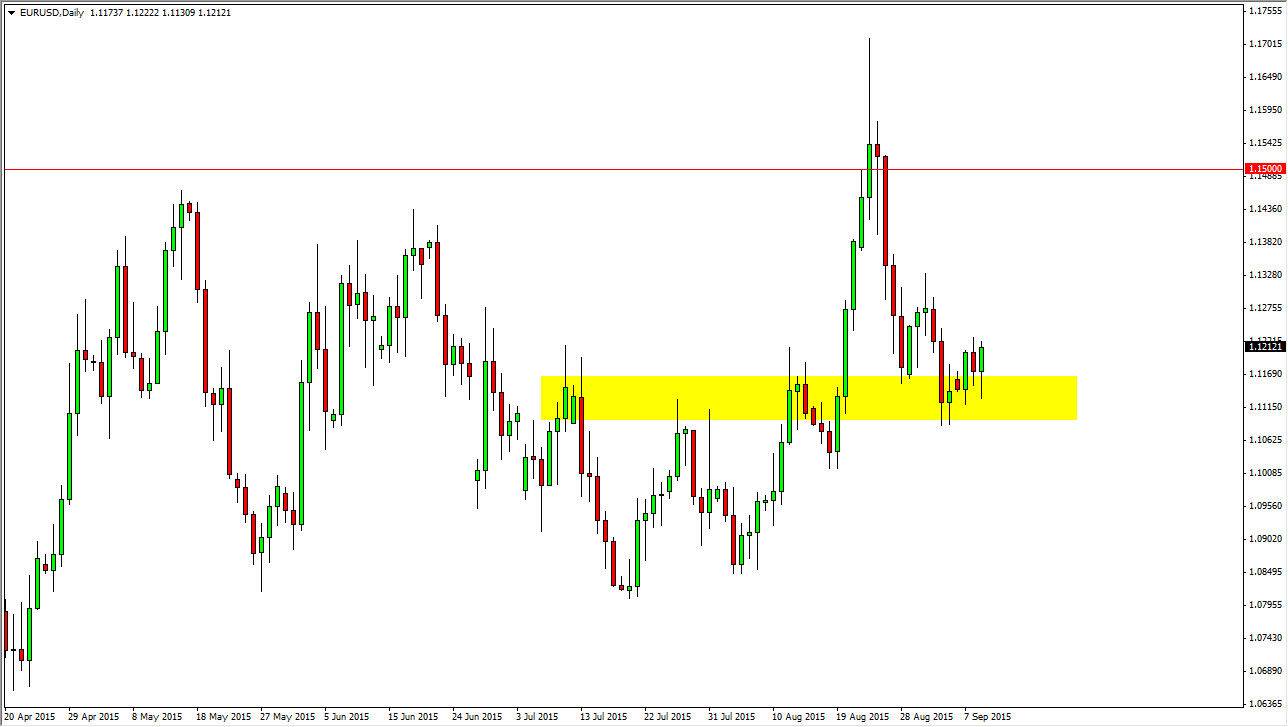

The EUR/USD pair fell during the course of the session on Wednesday, but found enough support near the 1.1150 level to turn things back around and form a massive hammer. This is of course a very bullish sign, and as a result I feel that it’s only a matter time before we bounce yet again. I believe that there is support all the way down to the 1.11 handle, and that overall the market should bounce back towards the 1.13 level. Overall, the consolidation is a symptom of lack of clarity in my opinion. It is a lack of clarity with the Federal Reserve and what they are going to do with interest rates that keeps this market grinding away.

Looking at this chart, I believe that if we can break above the 1.13 level we could then go to the 1.15 level. Having said that, I think that it will take a bit of momentum building in order to reach that level though. Because of this, it makes sense that the choppiness continues.

Short-term trades

I believe that this market will only offer short-term trades, so I am actually looking towards short-term charts for signs of trading opportunities. I believe that we will continue to see a lot of back-and-forth type of action, so I am only hanging onto any trades that I take for a couple of hours at best. While frankly, this is not my favorite market traded at the moment, as there seems to be a lot of trepidation about getting involved.

Sooner or later, I feel that the market will have to break out obviously, but we aren’t showing any real signs of doing so quite yet. I suspect that the Federal Reserve will do an interest-rate hike, but it will probably be a one-time affair. If that’s the case, this market should ultimately break out to the upside, which would be signified by the breaking of the 1.15 level to the upside.