EUR/USD Signal Update

Yesterday’s signals expired without being triggered.

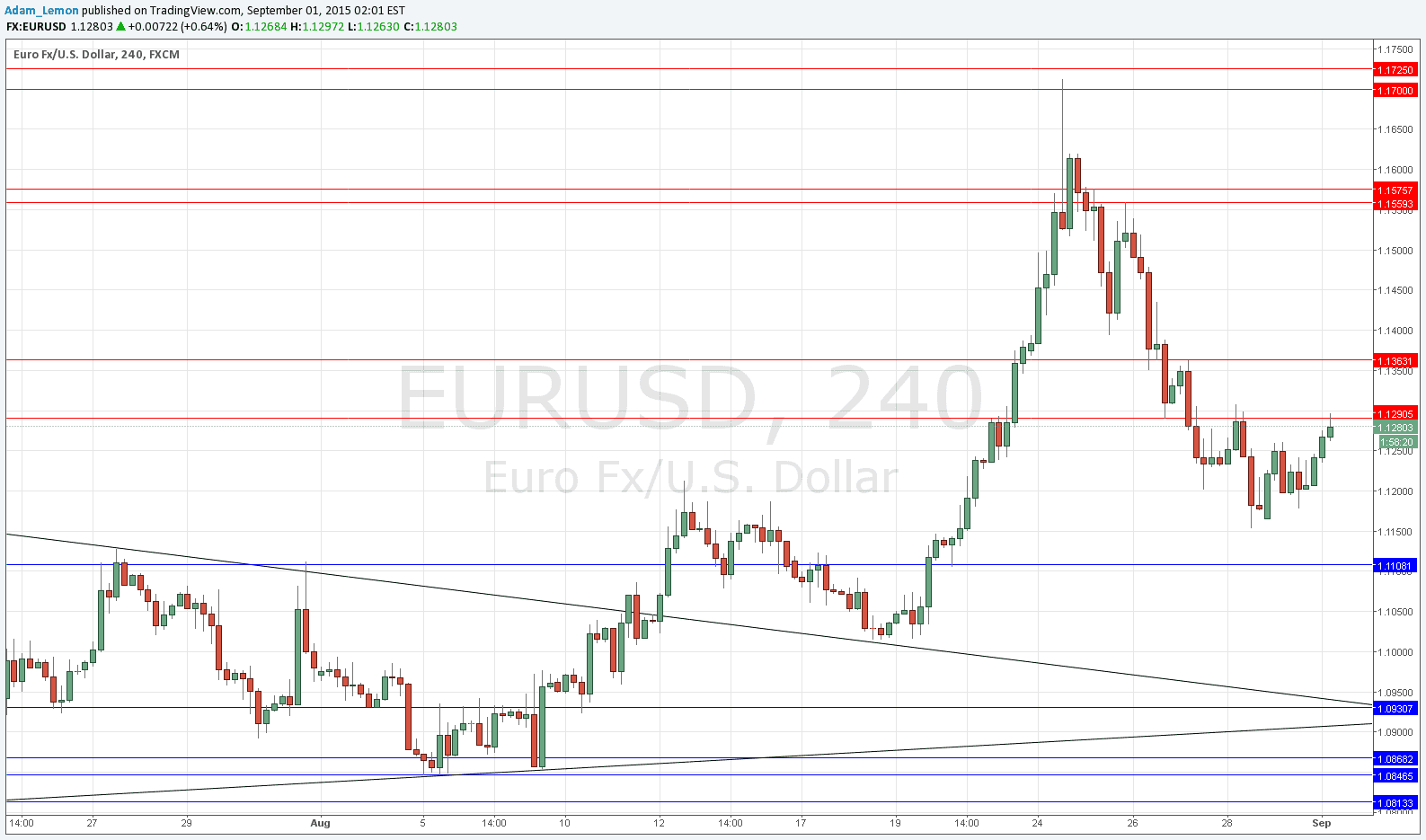

Today’s EUR/USD Signals

Risk 0.75%

Trades must be taken before 5pm London time today only.

Long Trade 1

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.1108.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 30 pips in profit.

Take off 50% of the position as profit when the trade is 30 pips in profit and leave the remainder of the position to ride.

Long Trade 2

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of the descending trend line or the horizontal level at 1.0930.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 30 pips in profit.

Take off 50% of the position as profit when the trade is 30 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Go short at 9am London time provided that the price is below 1.1275.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 30 pips in profit.

Take off 50% of the position as profit when the trade is 30 pips in profit and leave the remainder of the position to ride.

Short Trade 2

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.1363.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 30 pips in profit.

Take off 50% of the position as profit when the trade is 30 pips in profit and leave the remainder of the position to ride.

EUR/USD Analysis

The pair continued its small recovery overnight and in late Asian session trading, but is currently stuck at a resistance zone that starts just before 1.1300 at about 1.1290. This may cap the price and if the first hour of the London session produces a convincing bearish reversal, it suggests that the price is going to turn downwards again and fall to at least 1.1150 or close.

A break above 1.1300 may not be very convincing or last very long, as there is further resistance at 1.1365 which is likely to be hard to break.

There is nothing due today regarding the EUR. Concerning the USD, there will be a release of ISM Manufacturing PMI data due at 3pm London time.