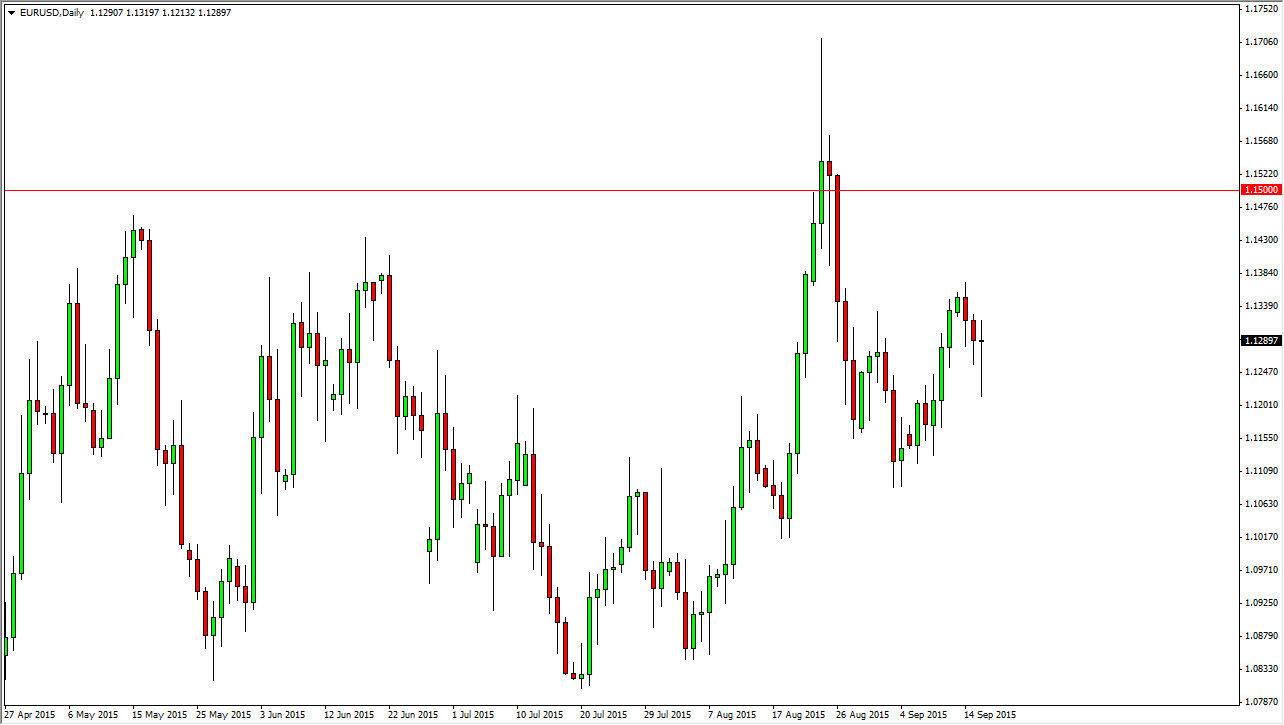

During the session today, we should see quite a bit of volatility in this pair. After all, the EUR/USD pair is essentially the gauge at which most people measure dollar strength. With the FOMC Statement coming out today, you can anticipate that there will be a lot of attention paid to the United States. However, I think this pair is already starting to tell us what it thinks.

After all, we did fall initially during the session on Wednesday, but found enough support at the 1.12 level to turn things back around. In fact, by the end of the day we had formed a hammer which of course is one of the most bullish candlestick you can have. With this, I think it shows that the market is expecting a certain outcome of the FOMC Statement, and a certain outlook coming from the Federal Reserve overall.

3 possibilities, 2 likely scenarios

There are 3 possibilities for the statement. The first one of course is that the FOMC does nothing, and simply sit still. This would be bearish for the US dollar and should send this pair going much higher, probably racing towards the 1.15 level as it shows just how onshore the Federal Reserve is about the US economy.

The second one is that they give an interest-rate hike, but suggest that there won’t be any other ones anytime soon. This would also be bearish for the US dollar as it shows that the Federal Reserve is going to be very cautious about trying to inflate the value of the US dollar, and of course jumping into normalized interest rates.

The third and least likely scenario is going to be that they have an interest rate increase, and suggest that there are more coming. I don’t think that’s what the market is anticipating, so I believe that any pullback at this point time has to be looked at as potential value. Having said that, if they do fire off an interest rate hike and suggest that more are coming, this pair will probably melt down.