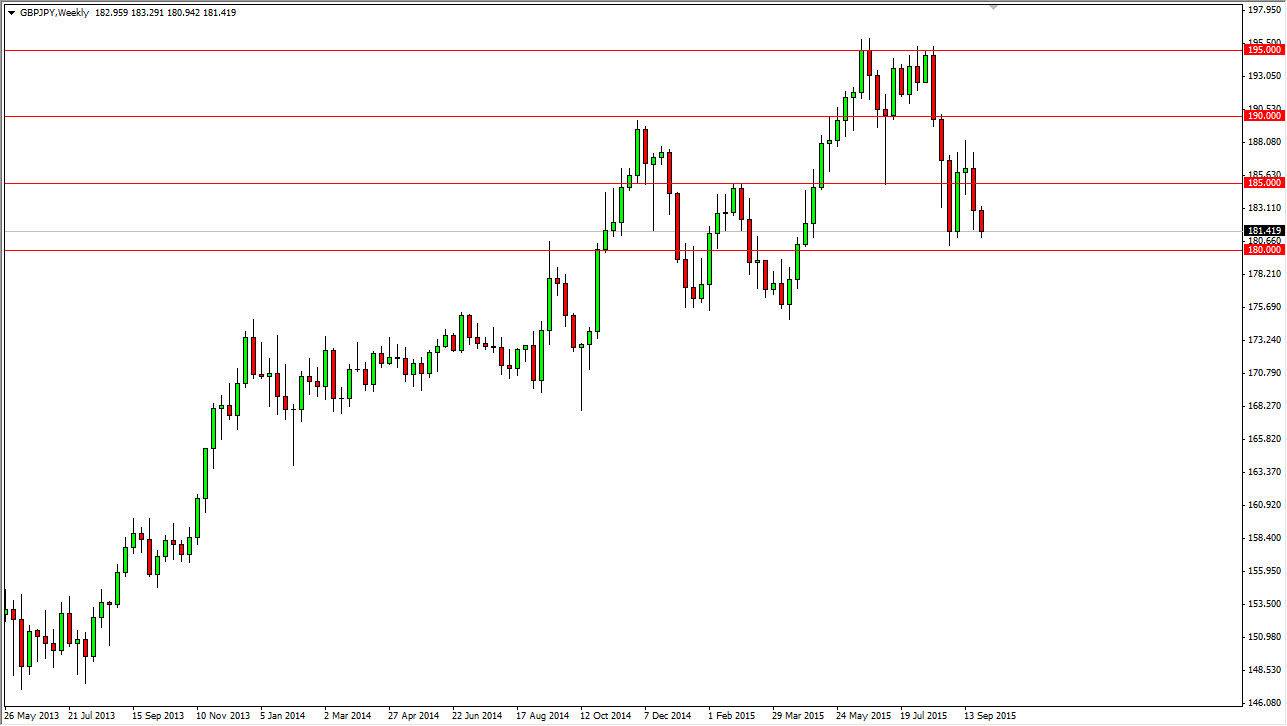

The GBP/JPY pair has been struggling as of late, as we find yourselves just above the 180 handle. However, there is a significant amount of support in this area, and you can probably make a pseudo-uptrend line just below as well to suggest that the buyers should return. With this, a supportive candle somewhere near the 180 level will more than likely signal a rally back towards the 186 level. I recognize that this pair has quite a bit of volatility just waiting to happen, as the British pound itself has been struggling. On top of that, it is very sensitive to risk appetite, which seems to be wavering from time to time in general.

Ultimately, I think this pair will have buyers step back in and push this market higher. However, I think that a lot of volatility is going to be the theme going into the next couple of weeks. With this, I think that short-term traders will continue to buy this market in short-term trades.

The importance of 180

I believe that the 180 level is essentially a bit of a “floor” in this marketplace and as a result it’s only a matter of time before we find buyers in this region. I think that this market is going to represent a decent buying opportunity, but we need to have a stable global market in order to do so. Stock markets need to find a little bit of support, as they have been selling off quite drastically over the last several weeks. However, if we get some type of stability and confidence building situation, this pair should continue to go higher. Don’t forget, this pair tends to move rather rapidly, so if you catch it as it bounces, you could find quite a bit in the way of profits.

On the other hand though, if we do find yourselves below the 175 level, I think at that point in time the trend is over and we probably fall apart.