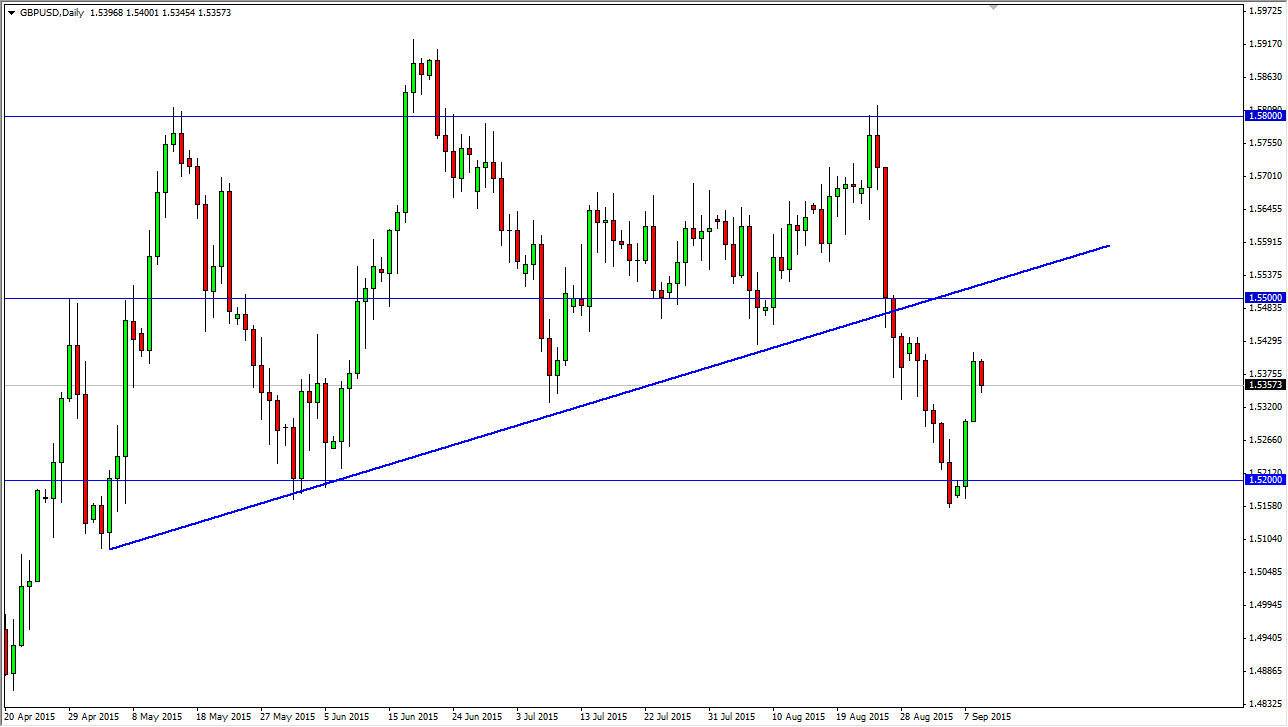

The GBP/USD pair fell slightly during the course of the day on Wednesday, which of course makes quite a bit of sense as we had reached a bit of an overbought condition. The 1.54 level of course affected the market in a negative manner as it is a large, round, psychologically significant number, but we have a huge announcement coming out today, the interest-rate decision by the Bank of England. While I do not anticipate any type of change in the rate itself, I do recognize that the rate statement will be looked at with great interest by currency traders around the world.

With this being the case, expect a lot of volatility in the marketplace today. However, I’m still only looking to sell this market, because of the breakdown of the uptrend line that we had seen keep this market higher during the course of the summer. Because of this, the market will more than likely find that uptrend line now resistive, which of course is one of the basic tenets of technical analysis.

The 1.55 level

I believe that the 1.55 level is massively resistive as well, and it is not until we break well above there that I would consider buying. I think that if we make a move towards that area during the session, it’s very likely that the sellers will come back in and push this market down. Quite frankly, I would love to see some type of short-term rally that I can sell into. On the other hand, if we break down below the bottom of the range for the session on Wednesday, that would also be a selling opportunity as far as I can see as it would show a continuation of the downward pressure. The 1.52 level below is significantly supportive, and that of course will keep the market somewhat afloat. I believe that sooner or later we are likely to break down below there though, and start reaching towards the 1.50 handle.