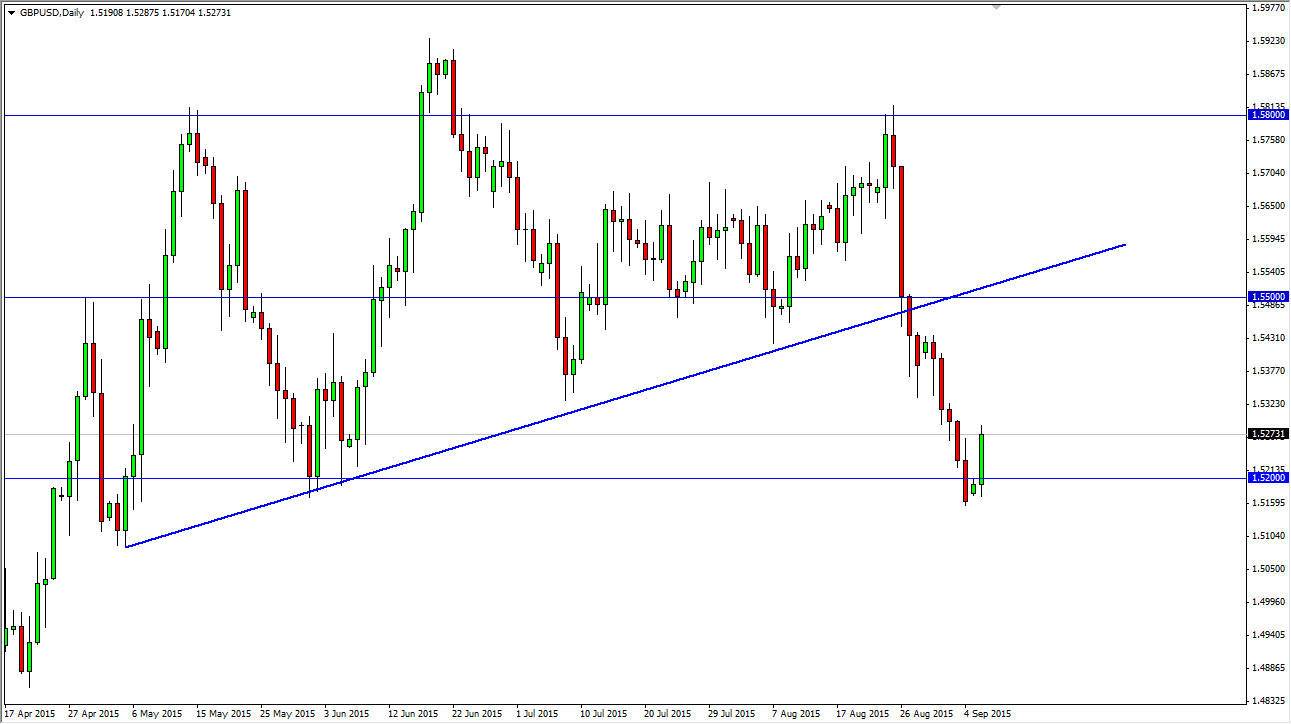

The GBP/USD pair bounced during the session on Monday, using the 1.52 level as a bit of a springboard. This is an area that has been supportive in the past, so it’s not a huge surprise that we bounce from here, but quite frankly the reality is that we broke down below the bottom of the uptrend line that had been so reliable since May. Because of this, I feel that the trend either has changed, or we are starting to work into some type of larger consolidation area.

With this, I feel that more than likely we will continue to bounce from here but should see quite a bit of resistance above current levels. This will be especially true near the 1.55 handle, as it was previously so supportive. On top of that, you have to think that the uptrend line will now become resistance, so at that point in time it’s only a matter of time in my opinion before we see sellers come back in.

Waiting for weakness

There should be weakness in this market given enough time, and I believe that this bounce was predicated not only upon the support that we obviously have at the 1.52 level, but the fact that the Americans were away at Labor Day suggests that you can only read too much into the sudden bullishness.

I believe that the 1.5 for area will be resistive, as well. Because of this I think that this market really is living on borrowed time as far as the upside is concerned. I’m simply going to wait for some type of resistive candle or an impulsive red candle in order to start selling. In the meantime, patience will be needed to simply allow this market to “come back to me.” With fact, this is the essence of trading, as Jesse Livermore once said, “We are paid to wait sometimes.” I think that’s what’s going on right now.