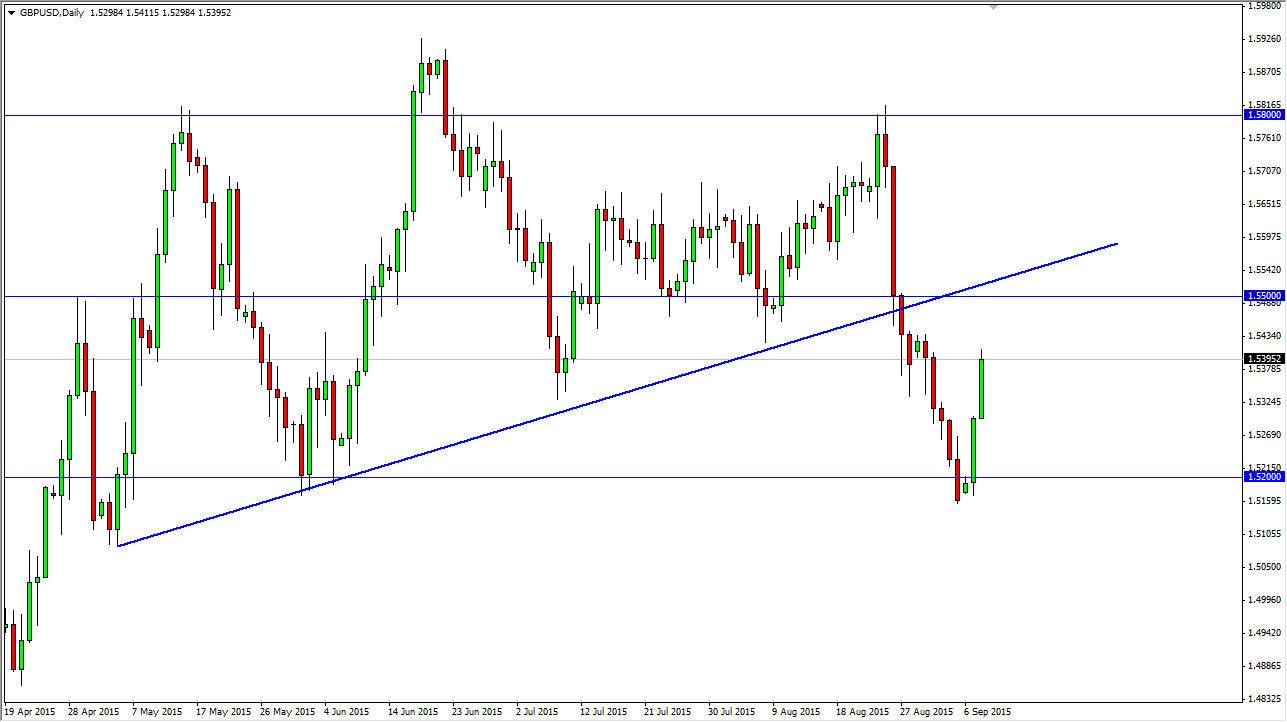

The GBP/USD pair rose during the course of the session on Tuesday, breaking towards the 1.54 level. This is an area that has been supportive in the past, so it should now start to offer resistance. However, we have not seen that yet, so it’s very likely that the market will have to test higher levels. Nonetheless, I still think that breaking down below that significant uptrend line that had been a feature of this market during the majority of the summer is a big deal. In fact, I feel that this market is going back to test the bottom of what was previously supportive. I think that it is not until we get well above the 1.55 level that we can consider buying this market and therefore I am simply waiting for a selling opportunity at higher levels.

Economic announcements

There is Estimated GDP and several other announcements coming out of Great Britain today. This of course can move the British pound, and as a result I feel it’s only a matter of time before we get some more volatility. Yes, this is been a strong move to the upside off of what was obviously support at the 1.52 level, but at the end of the day I feel that this is simply a bounce in a bigger move. As long as we are below the 1.55 level, I feel that the sellers still have the upper hand, even though it has been rather bullish for the last couple of days.

All of that being said, I am waiting to see if I get a candle such as a shooting star on the 4 hour chart or above as the market will have exhausted itself. If we got a daily close significantly above the 1.55 handle, then I would be convinced that the market should head to the 1.58 level given enough time. However, at this point in time I still think that the sellers are going to be in control before it’s all said and done.