Gold prices ended Friday's session down $8.28, to settle at $1145.60 an ounce as the dollar pared losses after a report showed the U.S. economy grew more than forecast in the second quarter and Federal Reserve Chair Janet Yellen said the central bank is on track to start raising interest rates this year. According to the Commerce Department, gross domestic product rose at a 3.9% annualized rate. Still, the precious metal posted a weekly gain of 0.58% on expectations the Fed will hold off raising rates until December.

The recent batch of economic data shows that there is enough economic activity to encourage the Fed to think about normalizing policy, but apparently policy makers pay great attention to global market developments and stubbornly low inflation, and this may continue to lend some sort of short-term support to gold. Friday's data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange increased their net-long positions in gold to 61125 contracts, from 39547 a week earlier.

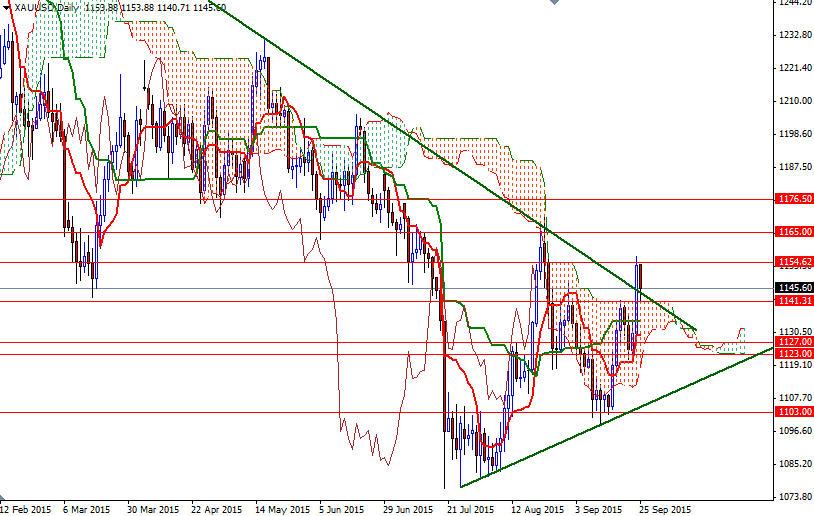

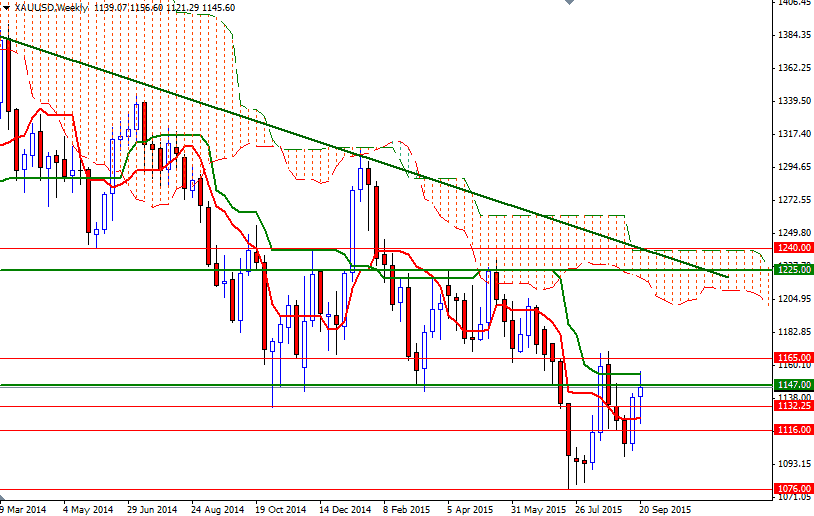

From a technical point of view, trading above the Ichimoku clouds on the daily and 4-hourly time frames suggests that the short-term technical outlook has shifted to the upside. We have a strong bullish Tenkan-sen (nine-period moving average, red line) - Kijun-sen line (twenty six-day moving average, green line) cross on the 4-hour time frame and the Chikou-span (closing price plotted 26 periods behind, brown line) is indicative of an upward momentum. If the bulls can maintain the control and hold the XAU/USD pair above the 4-hourly Ichimoku clouds, a retest of the 1154.62 level might be realistic. I think a sustained break above this level would give the bulls the extra power they need to visit 1165 and 1170. To the downside, the initial support can be found in the 1141.31 - 1139.90 region. If prices break below, then the next stop will probably be the 1134.35 - 1132.25 area. The bears will have to push XAU/USD below this support so that they can have a chance to test 1127 and 1123.