Gold started the week drifting lower, testing the support around the $1132 level, as traders took profits from a recent rally to the highest level in almost three weeks. In economic news on Monday, the National Association of Realtors reported that sales of existing homes fell 4.8% in August but the comments from Federal Reserve officials helped provide a lift to the dollar. Atlanta Fed President Dennis Lockhart, a voting Federal Open Market Committee member, said "As things settle down, I will be ready for the first policy move on the path to a more normal interest-rate environment. I am confident the much-used phrase 'later this year' is still operative".

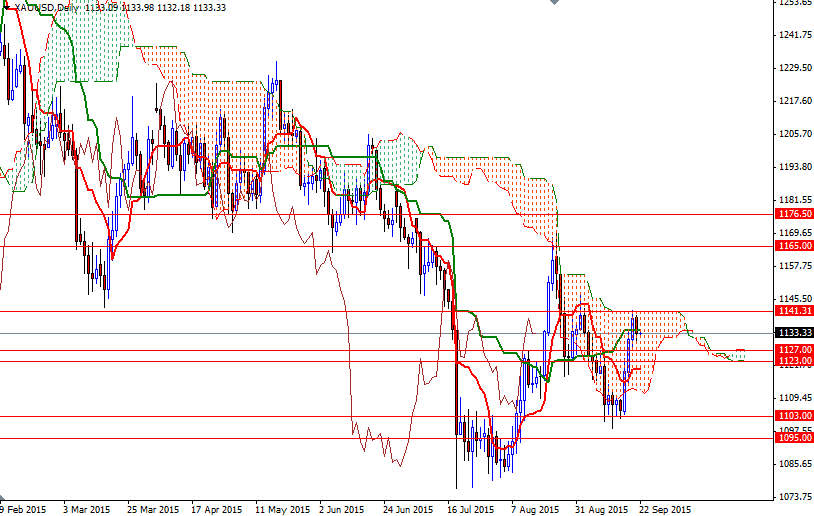

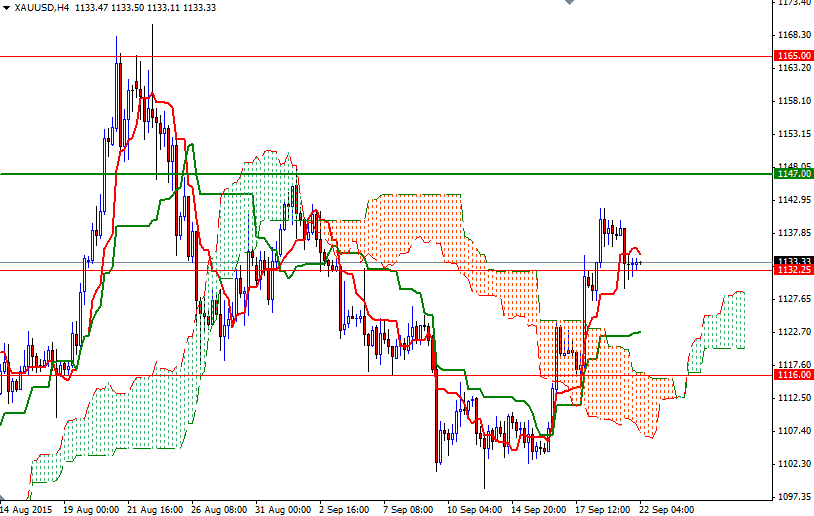

Technically, trading above the 4-hourly Ichimoku cloud suggests that the recent upswing may remain intact as long as the market can hold above the 1116 level. On the other hand, the market's inability to penetrate the daily Ichimoku cloud is something to pay attention to, especially while the Tenkan-Sen (nine-period moving average, red line) is moving below the Kijun-Sen (twenty six-period moving average, green line) on the same chart.

That said, I expect the near-term trading range to be roughly between 1141.31 and 1127. If the market fails to hold above the 1132.25 support, then prices will probably fall to the 1127 level. The bears will have to shatter this support so that they can make an assault on the 1123 level. A close below this level would increase the downward pressure and take us back to 1116. However, if the XAU/USD pair resumes its recent bullish sentiment and penetrate the barrier at 1141.31, the bulls may find a chance to test the 1147 level. Beyond that, the next challenge will be waiting the bulls at 1154.62.