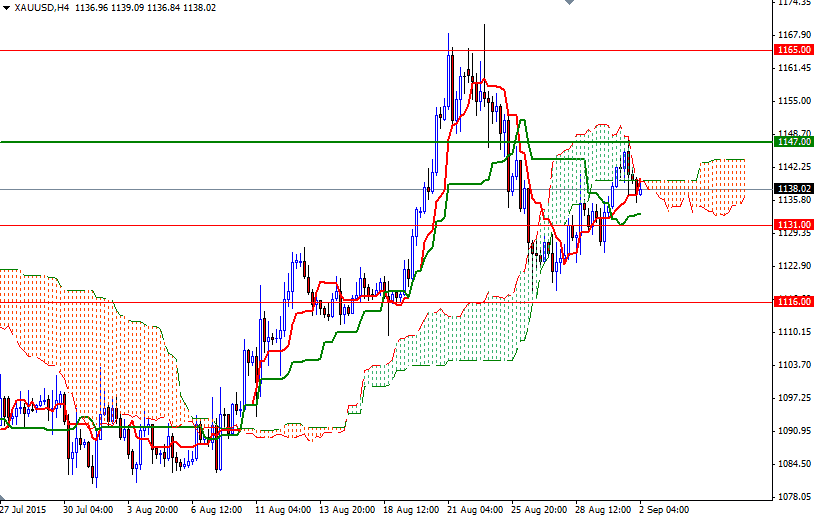

Gold prices rose $5.31 an ounce yesterday, up for the third straight session to $1139.98, as losses across global equities increased investors’ appetite for the precious metal as an alternative investment. The XAU/USD pair tried to penetrate the $1147 resistance in wake of renewed volatility in stocks but the bulls run out of steam and as a result the market trimmed a portion of initial gains.

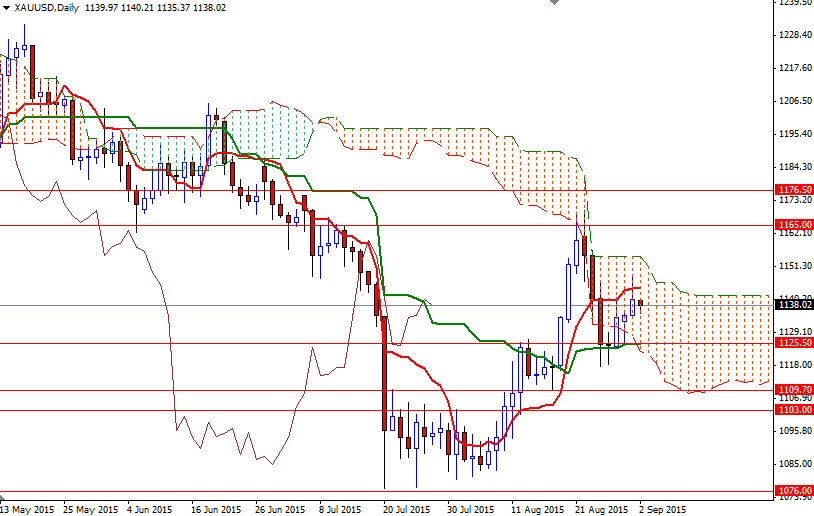

Trading within the boundaries of the Ichimoku cloud on the daily chart implies that the market will be range bound over the short-term. In addition to that, the daily Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines are flat, indicating lack of real momentum. With that in mind, I will be keeping an eye on the 1147 and 1131 levels.

If the bulls penetrate this first barrier ahead of them, then it may be possible to see the XAU/USD pair testing the next resistance at the 1155 level which happens to be the top of the daily could. Closing above the 1155 level on a daily basis could provide the bulls the extra fuel they need to march towards the 1165 resistance. If the bears take the reins and drag prices below 1131, they may have a chance to revisit the next support at 1125.50 - 1122.84. Since the daily Kijun Sen and the bottom of the cloud converge in this area, shattering this support is essential for a bearish continuation.