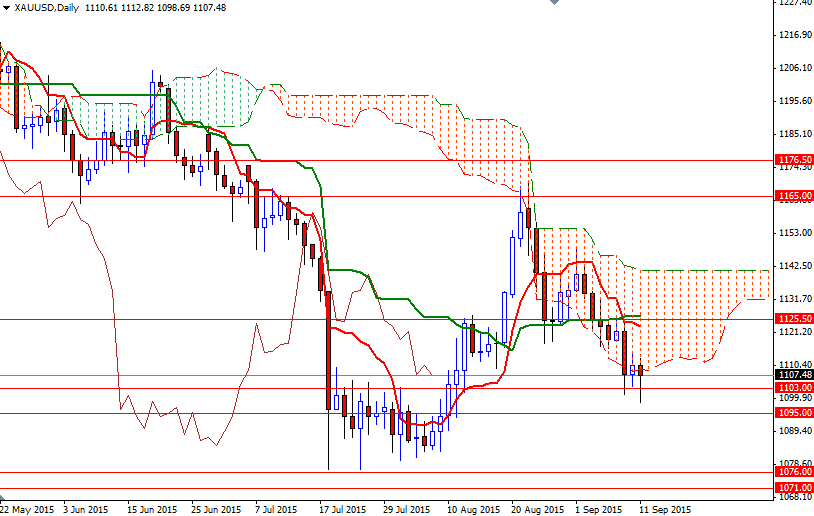

Gold prices settled at $1107.48 per ounce, falling nearly 1.42% over the course of the week, as calmer financial markets and generally positive U.S. economic data eased demand for the perceived safety of the metal. The XAU/USD pair dipped to a low of $1098.69, a level last seen on August 11, before bouncing back to the $1107 area. Gold has been struggling for some time because of the persistent improvement in U.S. data and perception that the likely timing of the first Fed rate increase since 2006 is drawing closer.

Despite increasing concern about the global economic recovery and speculation of a sharp slowdown in Chinese growth, people tend to flock to treasuries rather than gold. Friday's data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange reduced their net-long positions in gold to 59293 contracts, from 72685 a week earlier. The market will be waiting for the Fed's decision at the end of its two-day policy meeting on Wednesday.

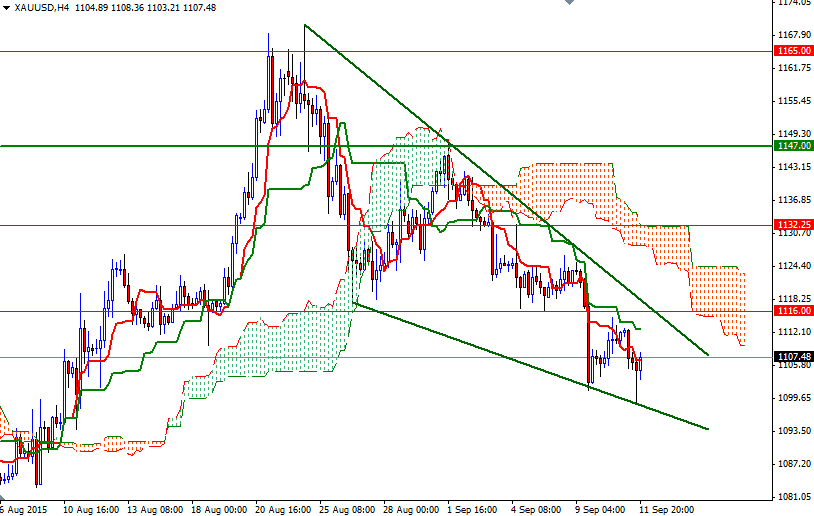

There are no signs that the strongly bearish trend has ended, holding above the 1103 level implies that market players are pricing in a low probability of a September hike though. From a short-term perspective, the area around 1103 has been (resistive in the past) supportive recently, and should continue to be so in the near term. However, if the bulls fail to defend their camp there, then the 1095 level might be the next port of call. Once the market shatters this support, I think we will see prices visiting the 1090/88 region afterwards. To the upside, the initial resistance is located at 1116. If XAU/USD breaks out of the falling wedge and closes above the 1116 level, prices will have a tendency to rise towards 1127/5.50. The bulls will need to anchor above the Ichimoku cloud on the 4-hour time frame so that so that they can challenge the bears on the 1132.25 battlefield.