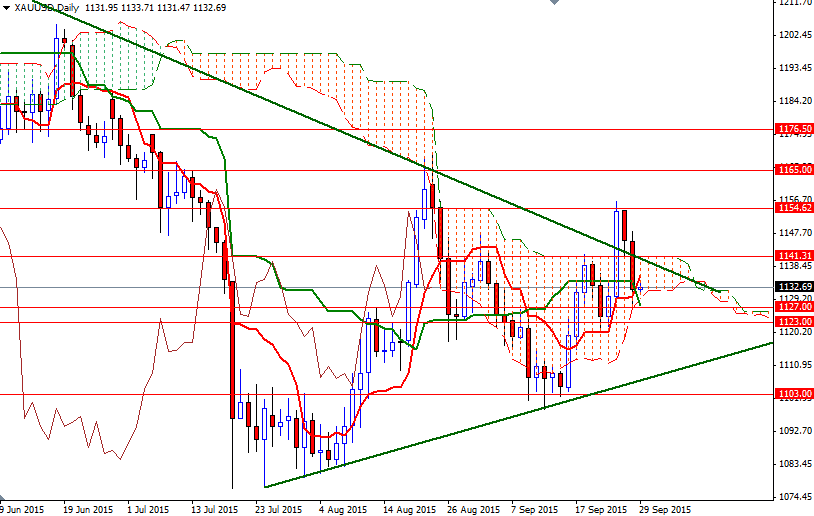

Gold prices dropped $13.57 an ounce yesterday, extending losses into a second session, as concern about the strength of the global economy and the timing of a U.S. interest rate hike kept pressure on commodity prices. Gold's surge in recent weeks was fueled partly by speculations Fed policymakers will delay interest rate plans. Long-side profit taking which was accelerated after the support in the 1141.31 - 1139.90 zone failed to hold prices up was also behind gold's decline yesterday.

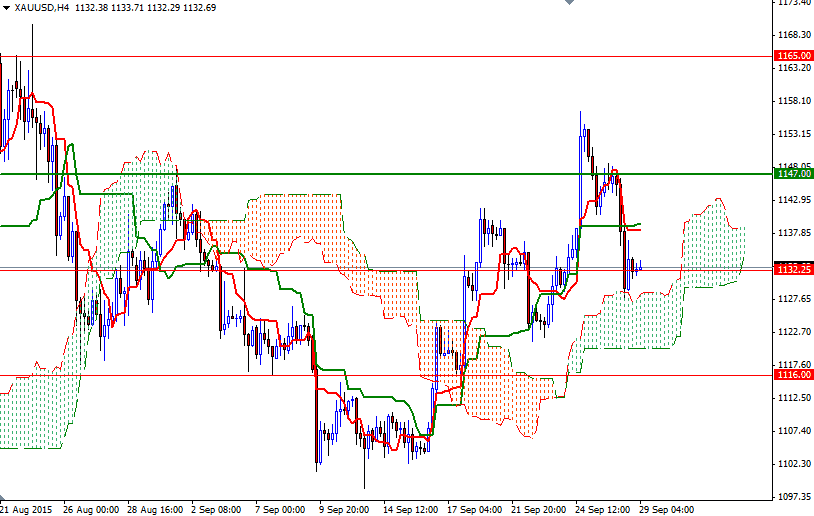

Not surprisingly, the XAU/USD pair pulled back to the Ichimoku cloud on the 4-hour times before it found some support. The market is currently trading within the 1134.35 - 1132.25 area I mentioned yesterday so I will be paying attention the price movement between these two levels. A failure to push prices above the 1134.35 could result in testing the support at 1127. If the 1127 support is broken then the bears will be aiming for 1123 and 1119 (the bottom of the 4-hourly cloud).

On the other hand, if the bulls take the reins and clear the resistance at 1134.35, we might see XAU/USD heading towards the 1141.31 - 1139.90 region where the top of the daily cloud and the 4-hourly Kijun-sen line (twenty six-period moving average, green line) converge. Only a close back above 1141.31 could open a path to the 1147 resistance level. Beyond that, the next solid resistance stands at 1154.62.