Gold started the week off on a sour note, extending its losses to a fourth straight session and hitting its lowest levels since August 18, as uncertainty about when the U.S. Federal Reserve may hike interest rates continued to weigh on the market. Although the XAU/USD pair grinded lower during the course of the day, the support at the 1116 level held the market and limited the potential downside.

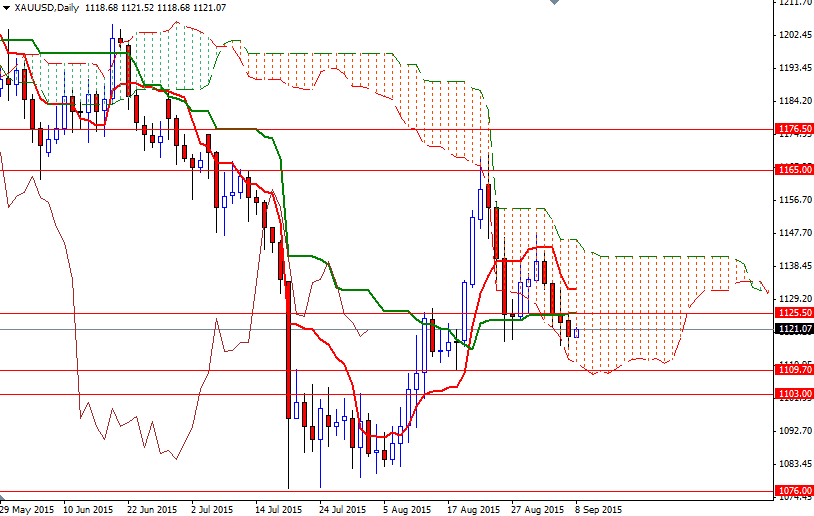

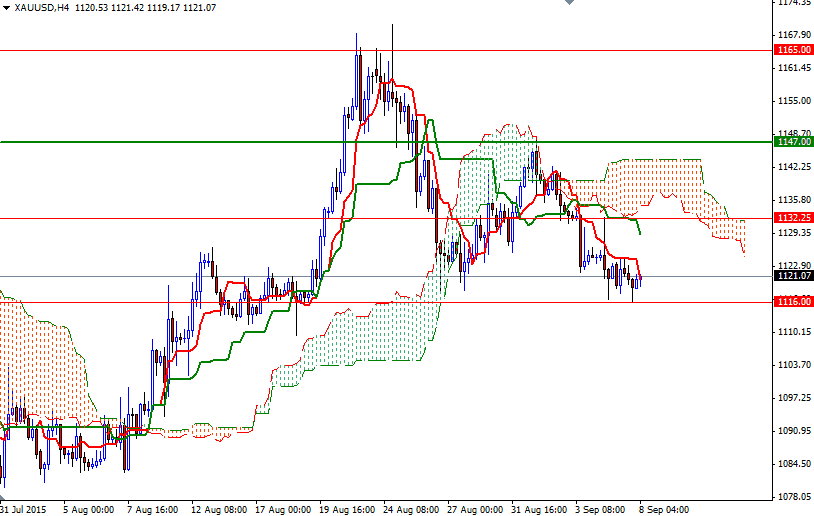

From a technical perspective, there are two things that I pay attention at the moment. Firstly, the market is trading below the Ichimoku cloud on the 4-hour time frame and there is a bearish Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-period moving average, green line) cross. Secondly, the XAU/USD pair is currently trapped within the borders of the cloud on the daily chart, plus the Tenkan-Sen and Kijun-Sen lines are completely flat. That means the rangy conditions with a bearish bias persist.

The initial resistance now stands at 1127/5.50. If the 1116 support remains intact, we could see a test of this barrier today. The bulls will need to pass through there so that they can challenge the bears waiting in the 1135 - 1132.25 zone. Beyond 1135, expect to see heavy resistance as the daily and 4-hourly clouds overlap. However, if sellers increase downward pressure and the 1116 support level falls apart, then it is likely that the market will visit the 1109.70 - 1108 area afterwards. A break below 1108 would trigger a drop towards 1103.