Gold prices rose 1.13% on Wednesday as the American dollar weakened after economic data on retail sales and industrial production came in worse than anticipated. The Commerce Department reported that retail sales rose 0.2%, below consensus expectations of a 0.3% rise, and data released by the Federal Reserve showed that industrial production dropped 0.4% in August. The New York Fed's manufacturing index came in at -14.7, slightly up from the previous month's -14.9.

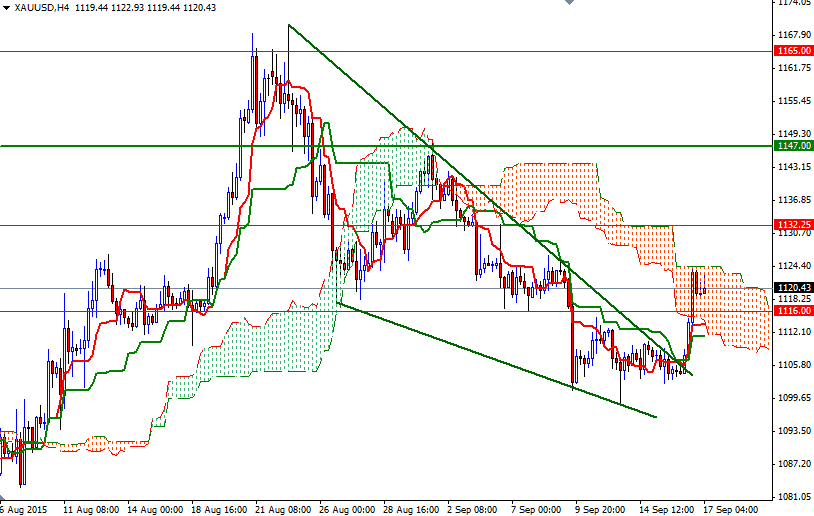

Market players are speculating that there is a distinct possibility that the Federal Reserve may hold off hiking interest rates until December. Although this view helps lift gold prices, gains in equity markets undermine the demand for safe-haven diversification. The market extended its gains and tested the resistance around the 1125.50 level after the XAU/USD pair broke out of the falling wedge and climbed above the first hurdle at 1116. Nonetheless, prices will probably tend toward consolidation, as traders await the outcome of the Federal Reserve's monetary policy meeting.

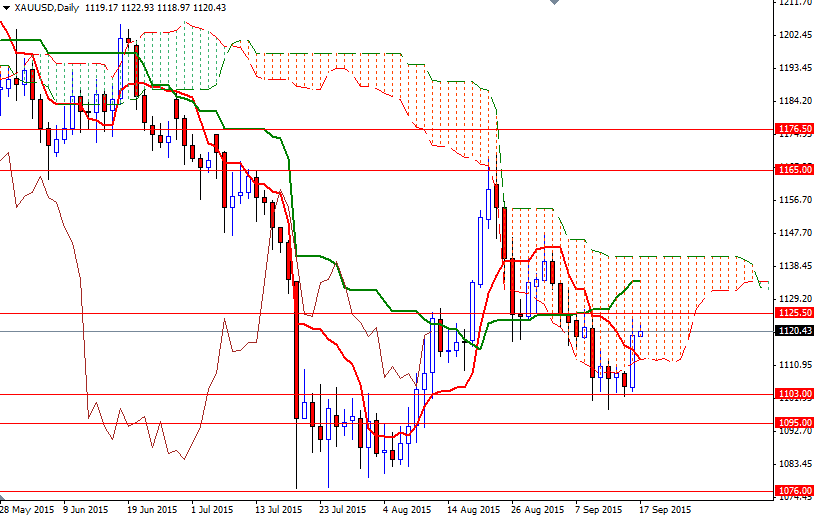

It is quite possible that the pair will continue its bullish tendencies if it can push through the 1127/5.50 resistance area. In that case, look for further upside with 1134.35/1132.25 and 1141.31 as targets. Once the bulls capture this strategic point where the top of the daily Ichimoku cloud sits, their next target will be 1147. To the downside, the initial support stands at 1116, followed by 1111.40. If the bears take over and drag prices below 1112.65-1111.40, I think XAU/USD will revisit the critical support at 1103. Breaching this support could accelerate downward movement and send prices back to the 1197.54-1195 region.