Gold prices rose $12.05 an ounce yesterday, benefiting from a weaker dollar and falling U.S. Treasury yields after policymakers at the Federal Reserve decided to keep interest rates on hold in September. "Recent global economic and financial developments may restrain economic activity somewhat and are likely to put further downward pressure on inflation in the near term...The Committee continues to see the risks to the outlook for economic activity and the labor market as nearly balanced but is monitoring developments abroad" the Fed said in its statement. Although the U.S. central bank left interest rates unchanged, it left open the possibility of rate hike later this year.

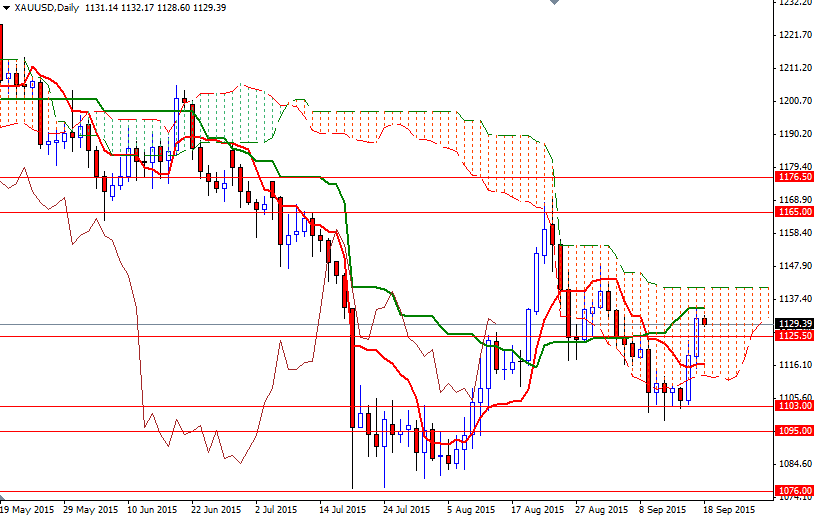

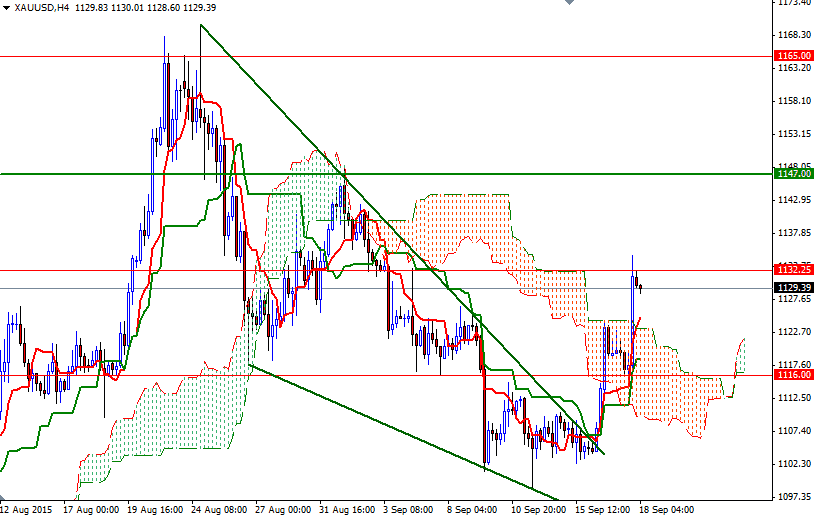

Yesterday's rally pushed the XAU/USD pair above the Ichimoku clouds on the 4-hour time frame. We also have a bullish Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-period moving average, green line) cross. XAU/USD is currently hovering around the 1129 level as the market tries to digest the recent gains. From an intra-day point of view, I will be keeping an eye on the 1127/5.50 (resistance) area which was broken yesterday.

If the bulls managed to defend this ground, it is likely that the market will retest the 1134.35/1132.25 area. Penetrating this barrier is essential for a bullish continuation towards the 1141.31 level - the upper boundary of the daily Ichimoku cloud. However, if they run out of gas and prices fall through 1125.50, XAU/USD may retreat to 1120. Breaking below this support would open up the risk of a move towards the 1116 level.