Gold prices rose $7.52 an ounce on Friday, up for the third straight session to $1138.66, as a softer dollar, sagging risk appetite and intensifying worries over the impact of China's slowing economy on global economies lured some investors back into the market. The XAU/USD pair initially tested the support around the $1103 level and advanced to the highest level since August 3 at $1141.70 after investors pushed back bets on the U.S. central bank's rate "lift-off" to December or even into 2016.

"In light of the heightened uncertainties abroad and a slightly softer expected path for inflation, the Committee judged it appropriate to wait for more evidence, including some further improvement in the labor market, to bolster its confidence that inflation will rise to 2 percent in the medium term" Yellen said at a news conference held after the Fed announced it kept interest rates unchanged. Growing perception that the central bank will not make its first move until December could be supportive for gold in the near-term but the bearish mood towards commodities may prevent prices from going significantly higher in the long run.

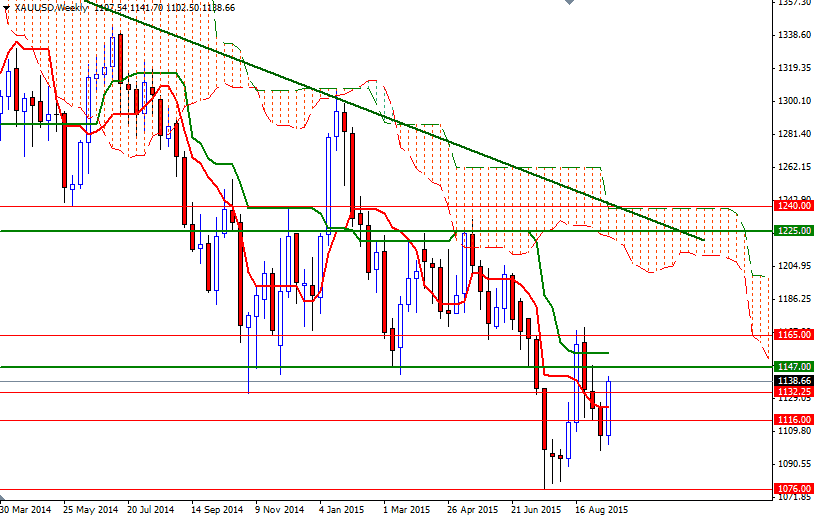

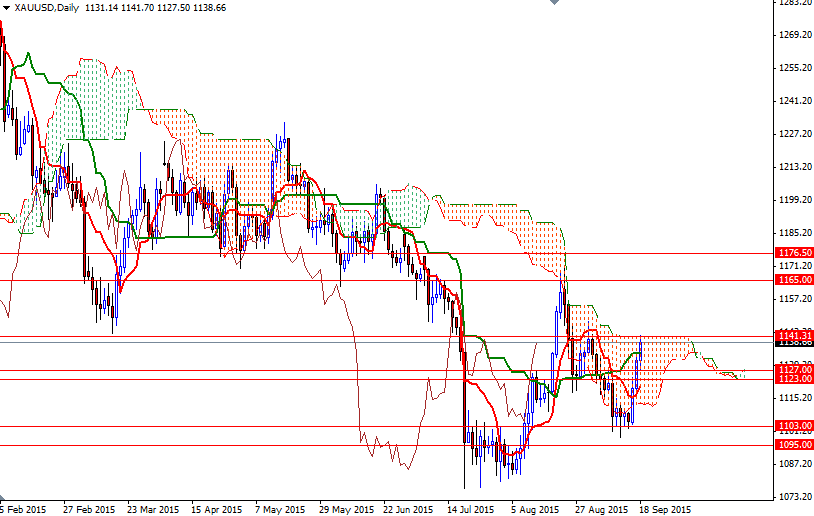

Speaking strictly based on the charts, the overall trend will remain bearish as long as the market trades below the weekly Ichimoku clouds (note that a long term descending reside in the same area). However, if the market remains above the 1116 level and anchors above the daily Ichimoku clouds, we may see XAU/USD testing the 1147 (a former support that had reversed prices a few times both in 2014 and 2015) and 1154.62 levels. The bulls will have to break through the 1154.62 level which happens to be the weekly Kijun-Sen (twenty six-period moving average, green line) so that they can start a journey to the 1176.50 - 1165 area. On the other hand, a failure to sustain a push above 1141.31 could weigh on the market and trigger some profit taking. In that case, that XAU/USD will test the 1132.25 level. If the bears eliminate this support, their next targets will be 1127 and 1123.