Gold prices edged slightly higher on Tuesday, snapping a four-day losing streak, as a retreat in the dollar sparked some short-side profit taking. It appears that the precious metal will tread water while uncertainty persists over China's growth outlook and U.S. interest rates. Last week's jobs report failed to provide a clear signal on the timing of the Fed's first interest rate hike in nearly a decade.

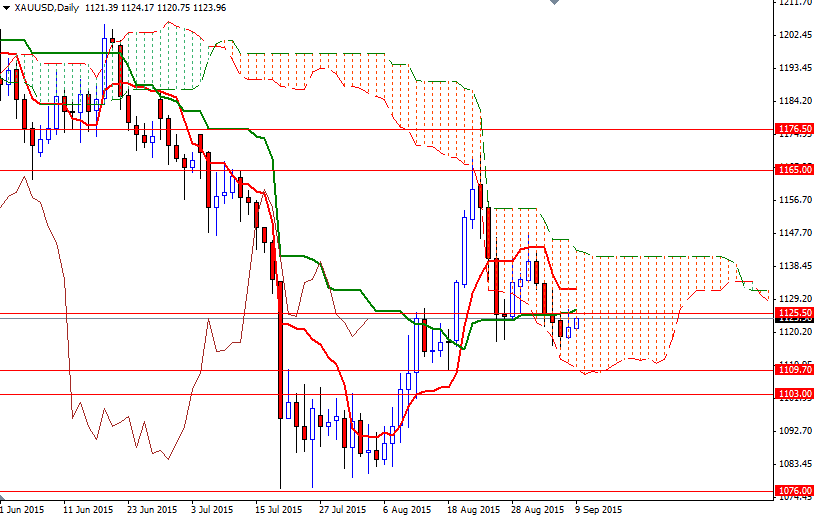

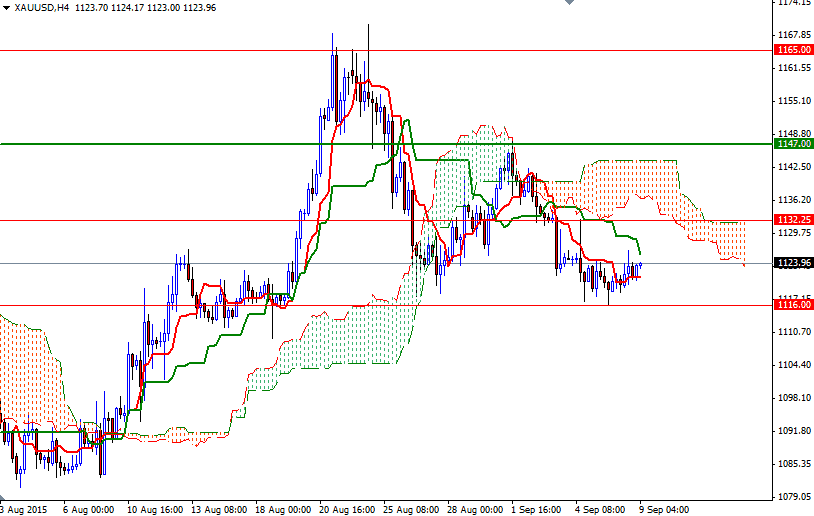

Recently the bulls have been trying to hold the market above the 1116 level but, as I mentioned yesterday, they have to push through the 1127/5.50 area so that they can gain enough traction to reach the 1135 - 1132.25 region. If prices close back above both the daily Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-period moving average, green line) lines, then we are likely to proceed to 1143.86 - 1141.31, where the upper band of the Ichimoku cloud resides.

On the other hand, if another move to the 1127/5.50 resistance runs out of steam, we could see the XAU/USD pair returning to 1116 again. A break below the 1116 would indicate that the bears won't give up before we revisit the 1109.70 - 1108 support zone. Beneath that, the key support stands at 1103. Since closing below this level would put the medium-term technicals in the same direction with the overall trend, look for further downside with 1095 and 1090 as targets.