Gold prices dropped for a third day and settled at $1127.18 an ounce, losing $4.77, as upbeat U.S. economic data fanned concerns about higher interest rates. A report released by the Conference Board showed that its consumer confidence index climbed to 103 from a downwardly revised 101.3 the prior month. The bulls have had their noses bloodied as of late and this has created an environment in which people are reluctant to go heavily long at the moment.

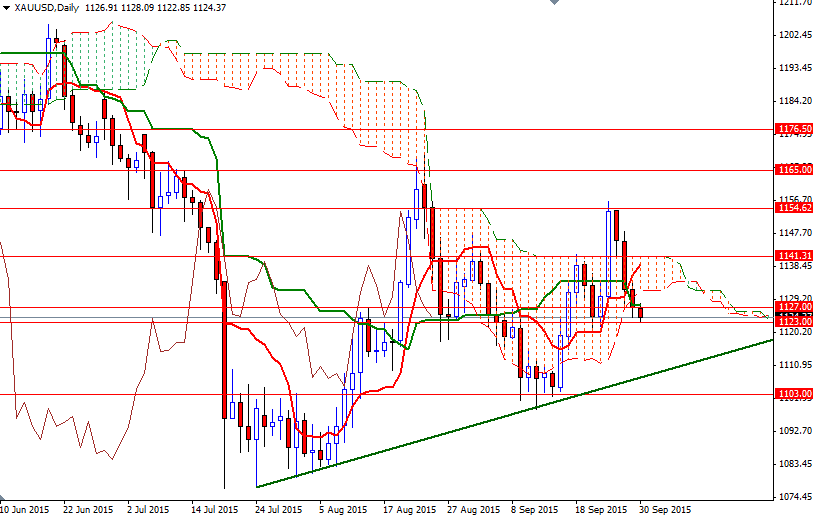

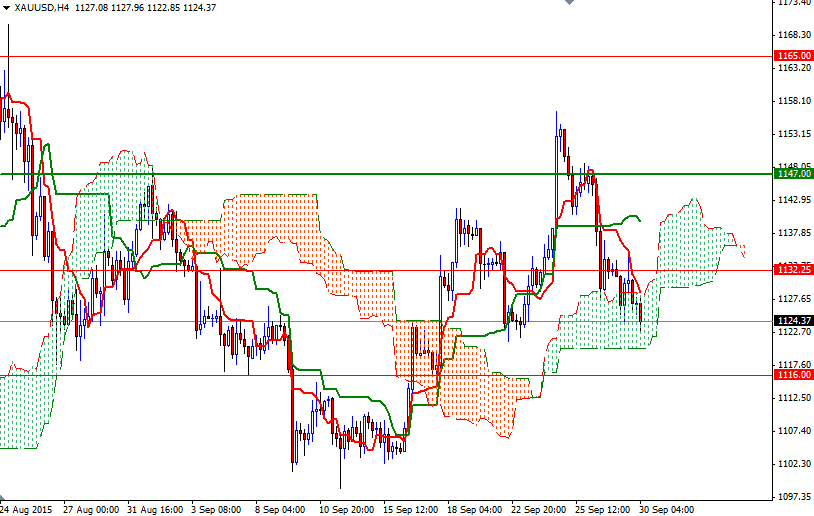

The XAU/USD pair is currently in the process of testing the 1123 support level, which the Ichimoku cloud on the 4-hour time frame overlaps. If this support holds, we will probably see a bounce towards the 1127 level. 1134.35 - 1132.25 will be the key level for the bulls to pass in order to challenge the bears at the 1141.31 - 1139.90 battle field.

However, if the market dives below 1123, then it is likely that the XAU/USD pair will visit the 1119 level. Once the bears manage to drag prices back below the 4-hourly cloud, they will have another chance to make an assault on the key support at 1116. Since closing below this level would encourage sellers, we might see a continuation targeting the 1109 level.