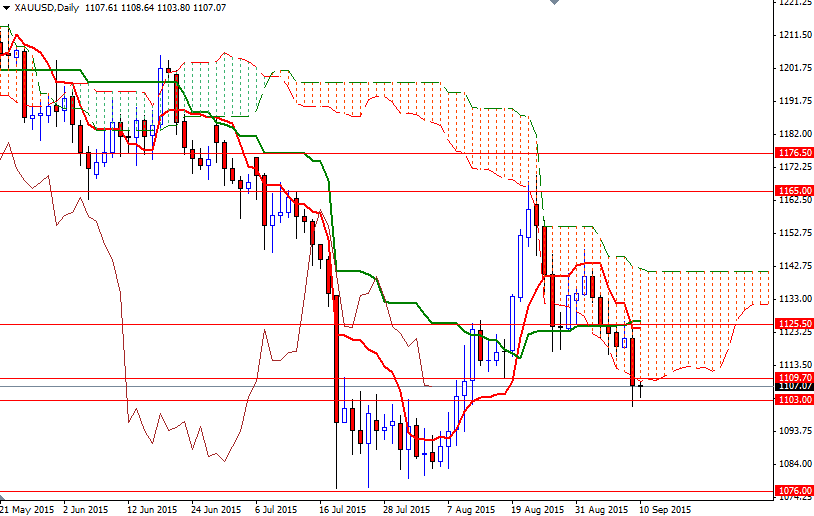

Gold prices ended Wednesday's session down 1.23% after a breach of the key support level at 1116 triggered a sell-off. The market initially tried to pass through the 1127/5.50 resistance area but encountered heavy resistance reversed its course. Not surprisingly, the XAU/USD pair accelerated its decline after the 1116 support was eliminated and eventually fell all the way back to the 1103 level.

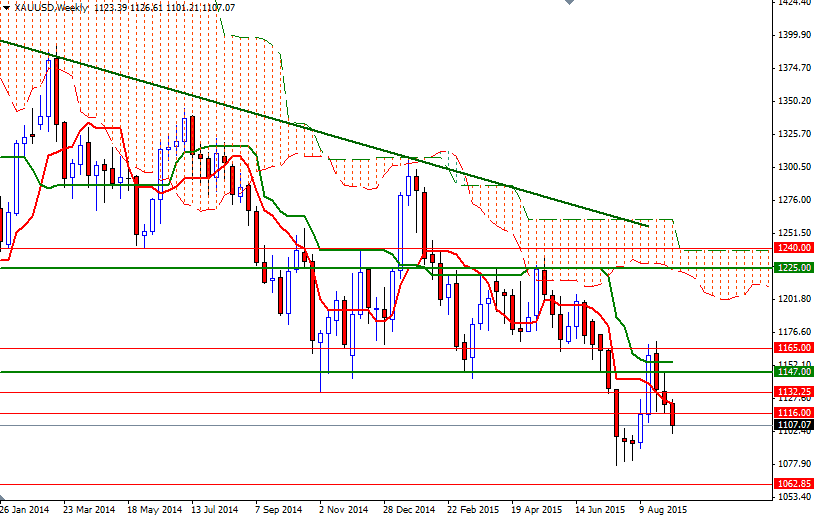

Technically, closing below the Ichimoku cloud on the daily time frame puts additional pressure on the market. Now we also have a bearish Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-period moving average, green line) cross on the same chart. However, as I pointed out yesterday, the area around 1103 has been supportive in the past so I will be paying attention to price action there. If 1103 holds I will look for prices to bounce and revisit 1109.70 and possibly 1113. We can expect the previous support at 1116 to flip and act as good resistance.

However, it is quite possible that XAU/USD will continue its bearish tendencies if the 1103 support gives way. In that case, the 1195 and 1190 levels will be the next possible targets. A daily close beneath the 1090 level could send prices back to 1083 and then 1076.