Gold settled up $1.31 at $1108.87 on Monday but remained within the trading range of the past 3 sessions as the market cautiously awaits the start of the Federal Open Market Committee meeting this week. Although the precious metal found some support from recently, people are reluctant to take sizable positions before they see the Federal Reserve's next move. Concerns that a slowdown in China's economy may be more harsh than initially thought and wild stock market gyrations have increased uncertainty about the timing of any U.S. rate increase.

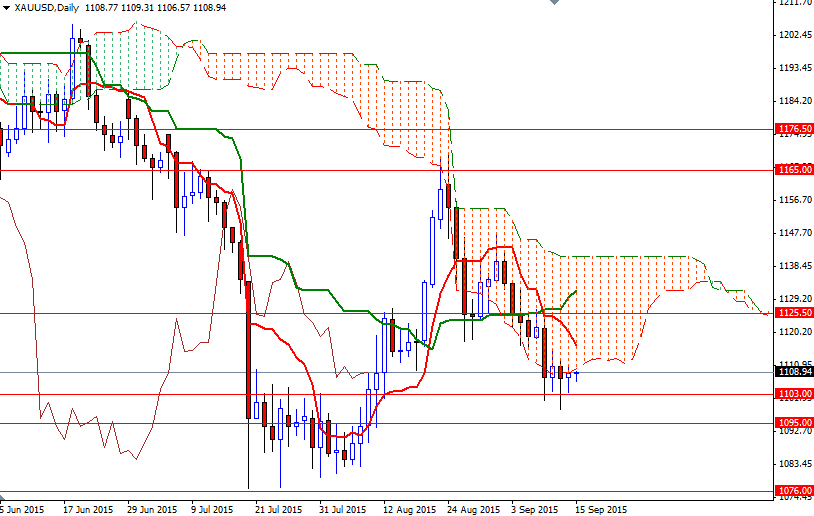

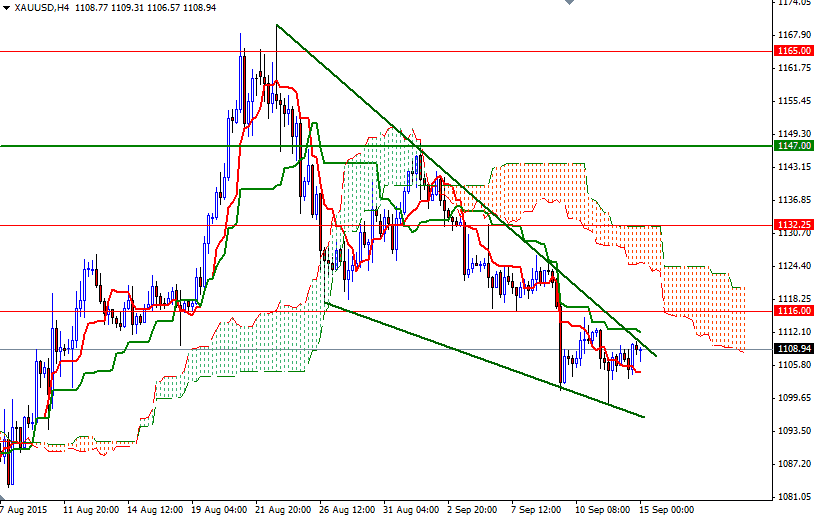

The downside risks remain while XAU/USD trades below the Ichimoku clouds on the weekly, daily and 4-hourly charts. Negatively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines also create a tough situation for the bulls. However, the direction that gold prices will take over the short-term depend on how currency and equity markets react to the Federal Reverse's decisions.

The XAU/USD pair continues to consolidate in a narrow range during today's Asian session and I will keep monitoring the key levels that I told in my previous analysis. If the market falls and breaks below the 1103 support, the bears may find another chance to test the nearby support in the 1097.54 - 1095 region. Breaching this area might encourage sellers and increase the possibility of an attempt to visit the 1090/88 support. To the upside, there are hurdles such as 1112.50 and 1116.48. If the bulls manage to hold the market above the hourly Ichimoku cloud and break out of the falling wedge, 1112.50 could be tested. Penetrating the 1116.48 resistance is essential for a bullish continuation towards the 1127/5.50 area.