Gold prices rose $3 an ounce yesterday as a retreat in the dollar index helped the metal trim a portion of the previous day's losses and climb back above the 1109.70 level. While some people feel that the Federal Reserve will likely wait beyond September to begin tightening given the recent market turmoil, others think that the string of upbeat reports shows the U.S. economy will be able to withstand an increase in interest rates.

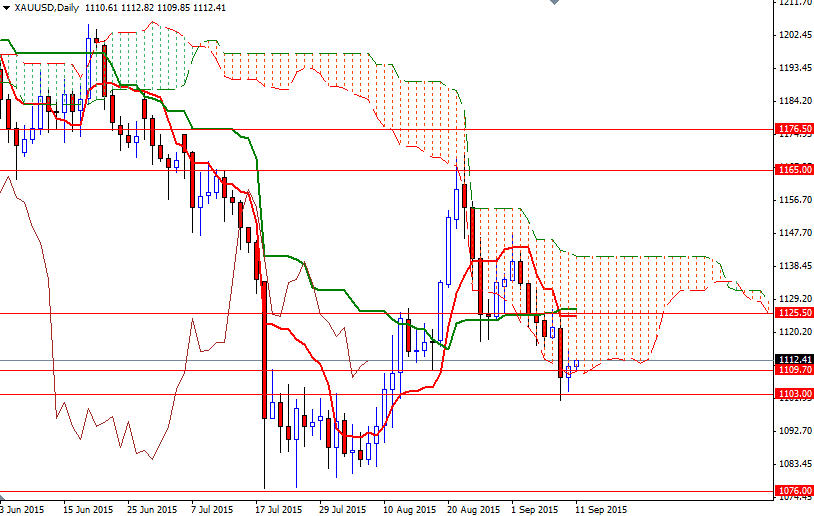

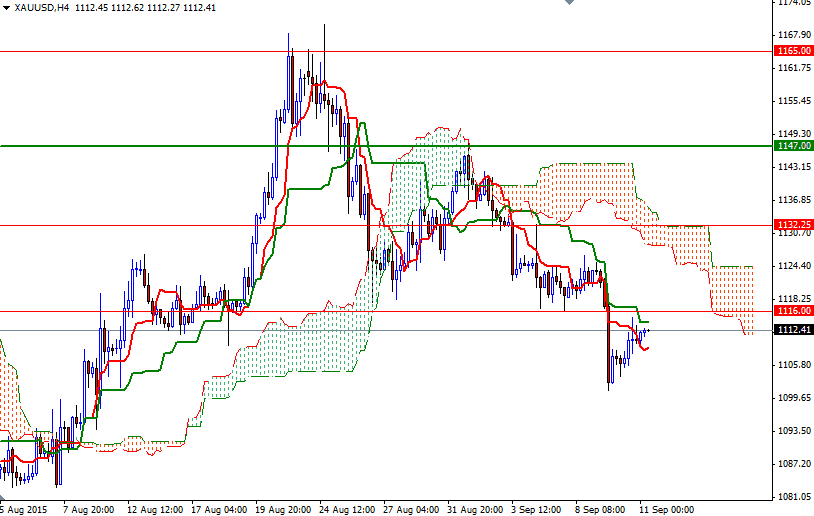

The XAU/USD is currently trading at 1112.41, slightly higher than the opening price of 1110.61. Although XAU/USD bounced off the support around 1103, the technical outlook remains weak. The market is trading below the Ichimoku clouds on the weekly and 4-hourly charts and we have bearish Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-period moving average, green line) crosses - including the daily time frame.

I think the support between the 1103 and 1109.70 levels will play a crucial role going forward. Breaking below the 1103 would imply that 1095 and 1090/88 levels will be the next stops. If this critical support is broken, prices could drop all the way down to 1076. In order to improve the short-term technical picture, the bulls will have to push prices above the clouds on the 4-hour chart. The initial resistance stands around the 1116 level. It is possible to see the XAU/USD pair challenging the 1120 and 1127/5.50 resistances if that barrier is cleared.